Bitcoin USD reportedly sits on the edge of the Federal Reserve’s 2026 bank stress tests, a move that would place crypto inside the same risk models as stocks and bonds.

The Bitcoin

price is trading this morning down -1.2% in the past 24 hours, now below $89,000, following a week of poor price action across crypto.

Bitcoin advocate Pierre Rochard just formally asked the Federal Reserve to treat BTC as its own variable in 2026 bank stress tests — citing 73%+ annualized volatility, massive drawdowns, and regime-shifting correlations that equities can’t proxy. Push for better risk modeling as… pic.twitter.com/hiAKLzqPeB

— Taurus – Bitcoin Bull (@Taurus4BTC) January 22, 2026

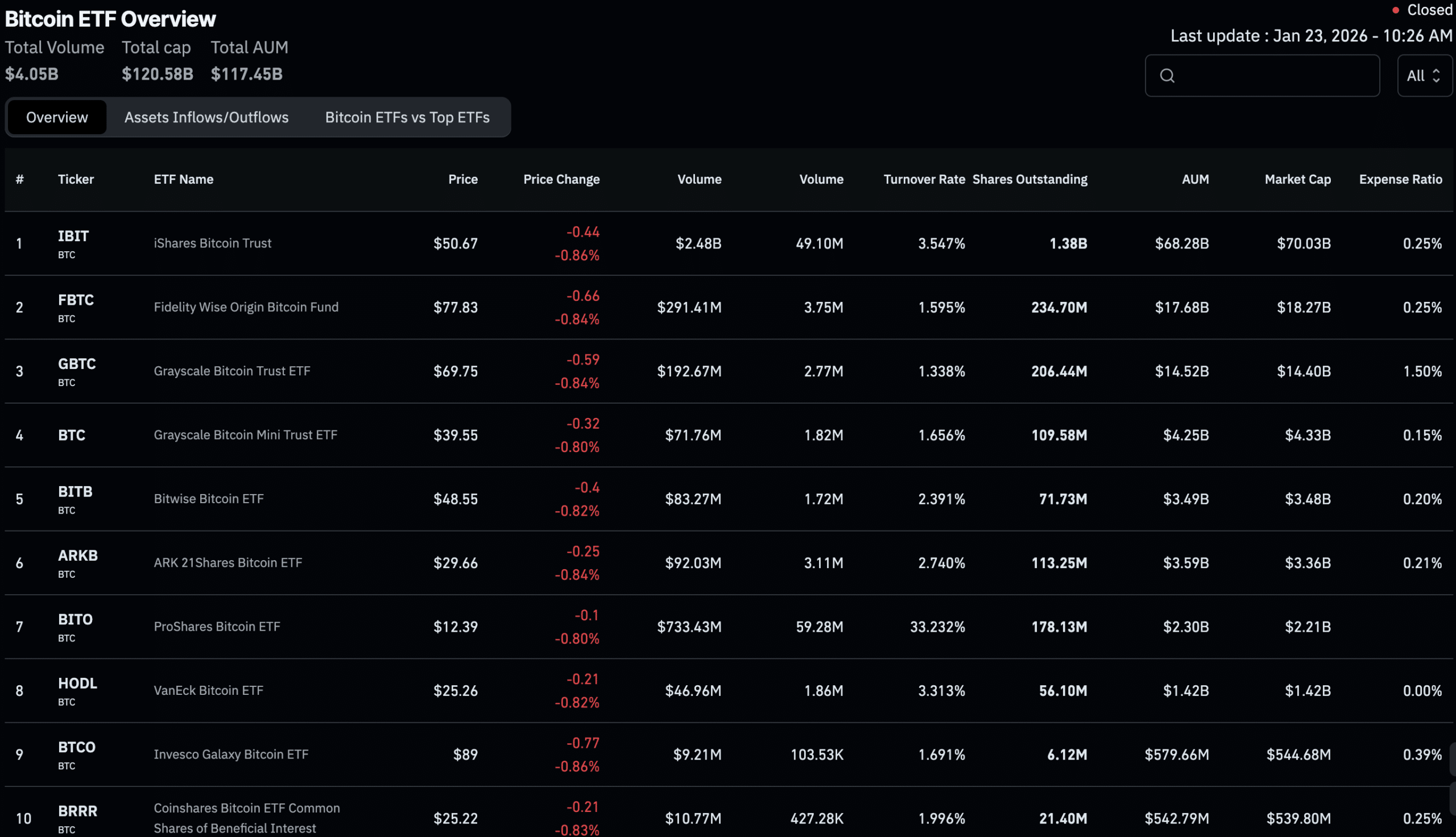

On a positive note for BTC, according to CoinGlass data, the BlackRock IBIT ETF surpassed $70Bn in market cap, further tightening its ties to the banking system and marking another milestone for the ETF space.

Zoom out, and this fits a bigger trend: US regulators are slowly treating Bitcoin less like a side experiment and more like a traditional financial instrument, and the money flowing in just proves it.

What are Federal Reserve Stress Tests, and Why the BlackRock IBIT ETF Could Mean Bitcoin Will be Involved

Federal Reserve stress tests are annual financial fire drills for big banks. Regulators imagine ugly scenarios: recessions, market crashes, liquidity freezes, and assess whether banks have enough capital to survive without taxpayer support.

Bitcoin is not in the tests yet. But banks now touch Bitcoin through ETFs, custody, and trading. When exposure gets large enough to affect a bank’s balance sheet, the Fed has a reason to model what a sharp Bitcoin crash would do to capital.

That connection comes mainly from ETFs. The BlackRock IBIT alone holds over $70Bn in Bitcoin, according to Bitbo.io. Big banks act as middlemen for these funds. If Bitcoin drops fast, margin calls and liquidity stress can hit regulated balance sheets.

Over 1.296M BTC is held across the 12 separate Bitcoin spot ETFs, accounting for 6.172% of the total supply. This widespread adoption of digital assets by trillion-dollar institutions highlights why it is likely a smart idea to begin including Bitcoin in the Fed’s stress tests.

(SOURCE: CoinGlass)

Banks Are Getting Closer to Bitcoin USD By Design

This did not happen overnight. In 2025, regulators rolled back several crypto roadblocks. The SEC removed SAB 121, making Bitcoin custody easier for banks. The Federal Reserve shifted oversight of crypto into its regular supervisory process rather than treating it as a special danger zone.

Translation for beginners: banks can now hold and move Bitcoin USD more like other assets. That makes Bitcoin safer to access through traditional channels. It also means regulators must measure their risks more carefully.

This is the same feedback loop readers saw during recent Federal Reserve liquidity injection stories. When Bitcoin plugs into the financial system, central banks start paying closer attention.

How Could Stress Tests Change the BTC USD Market?

BREAKING:

— Merlijn The Trader (@MerlijnTrader) January 8, 2026

🇺🇸 Scott Bessent confirms the U.S. has started a Strategic Bitcoin Reserve.

No buying.

No selling.

Confiscated BTC stays on the balance sheet.

Bitcoin just crossed into sovereign asset status. pic.twitter.com/WYRVdRM5aA

If the Federal Reserve adds Bitcoin to stress tests, it does not mean approval. It means standardization. Banks would model Bitcoin shocks the same way they model stock crashes or rate spikes.

That has two effects. First, banks tighten controls around Bitcoin activities. Think lower risk limits and more paperwork. Second, Bitcoin becomes harder to dismiss as a fringe asset because regulators now track it like other market risks.

For long-term holders, this cuts both ways. Tighter rules can reduce blowups tied to bank exposure. But they can also slow aggressive expansion in crypto-linked services.

Stress tests focus on worst-case scenarios. The Fed could assume a -50% or deeper Bitcoin USD crash in a short window. That forces banks to hold more capital to protect against crypto volatility.

More capital means higher costs. Banks may pass those costs on through wider spreads, stricter access, or fewer crypto products. However, everyday traders like you and I should not confuse “mainstream” with “risk-free.”

The next step is a measurement decision. If bank exposure keeps growing, the Federal Reserve will model Bitcoin because it has no choice, and that alone marks a quiet shift in how digital assets now fit into the financial system.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin USD May Enter Federal Reserve Stress Tests and Banks Feel the Heat appeared first on 99Bitcoins.