From Europe, South America, and the US, it is clear that Bitcoin and crypto are being institutionalized. The Bitcoin price, as a result, is heavily influenced by the big boys, so much so that retailers now play a minimal role.

This trend is expected to continue after the match was lit up in January 2024, when the US Securities and Exchange Commission (SEC), for the first time, approved spot Bitcoin ETFs. A few months later, spot Ethereum ETFs were given the green light but without staking. Since then, the Bitcoin price has been defying gravity, breaking key resistance levels and moving to six figures in 2025.

US spot Bitcoin ETF cost basis acting like a floor..

Smart money defending their entry! pic.twitter.com/Zxx2kC4S9A

— BACH (@CyclesWithBach) January 19, 2026

Since Wall Street is involved, and laws in the US are now pro-crypto, it is understandable that spot Bitcoin ETFs are closely monitored. After months of impressive inflows and choppy price action, cracks are beginning to emerge. The question now is: Will the Bitcoin price dive or, against expectations, soar to fresh all-time highs in the next few weeks?

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Bitcoin Liquidity is Evaporating: Spot BTC ETF Outflows A Concern

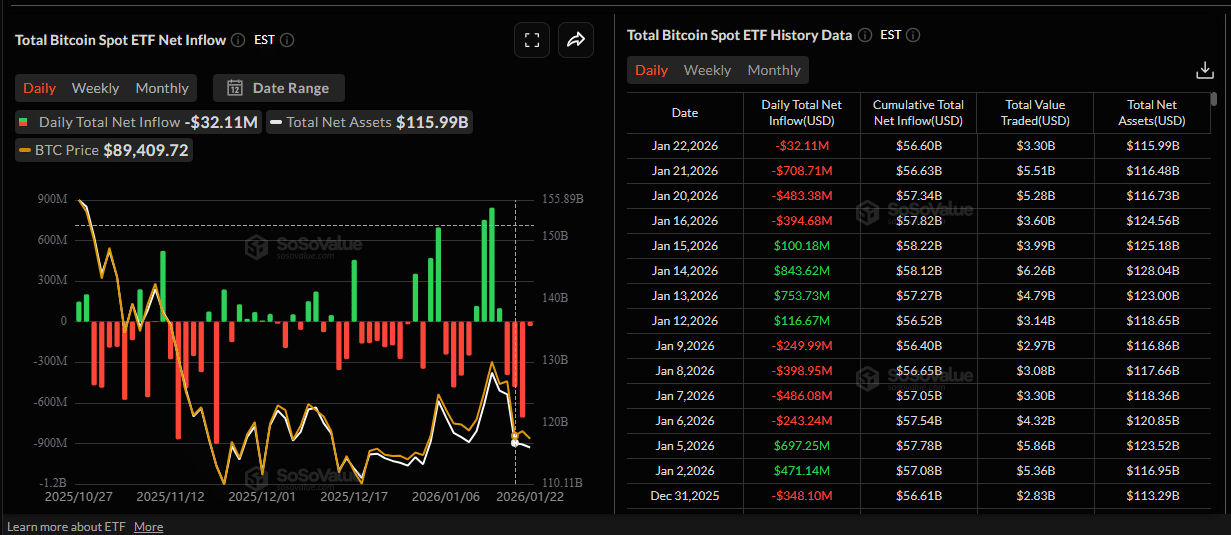

Every investor and trader tracking Bitcoin should be worried after this week’s events. According to trackers, spot Bitcoin ETFs redeemed over $1Bn worth of BTC-backed shares, reducing assets under management by issuers to roughly $116Bn.

Trackers show that on January 21, over $708M of spot Bitcoin ETFs were redeemed marking yet another day of outflows that began on January 16. Cumulatively, since institutions began selling their shares for cash, spot Bitcoin ETF issuers have had to sell over $1Bn of shares on demand. During this time, the Bitcoin price edged lower, slipping from as high as $95,500 to as low as $87,000 at one point this week.

(Source: SosoValue)

The direct correlation between outflows and price dips could explain a key development that’s happening. It is likely that the big boys are recalibrating their portfolios. As a result, the “hot money” that entered aggressively during the 2025 Bitcoin and altcoin expansion is either exiting, pivoting to bonds and other defensive assets, or locking in profits. Because analysts always track outflows, the accelerated sell-off this week is triggering a “risk-off” environment that may bait in retail sellers to dump.

This re-positioning and “risk-off” state can be seen in the stablecoin supply drop. Stablecoins like USDT and USDC are the liquidity bridge, linking TradFi with crypto. In the past week alone, the supply of USD-pegged stablecoins fell from $304Bn to around $302Bn. This is a problem because without liquid capital sitting on exchanges, even moderate sell orders cause larger price drops.

(Source: Coingecko)

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What’s Next For BTC USD and Top Cryptos To Buy?

How the Bitcoin price evolves in the next few days will likely shape the trend of Q1 2026. For now, traders are still recovering after the mass liquidation of the past few days following Trump’s announcements of new tariffs on eight EU countries. The mass liquidation of January 19 followed another wave of forced liquidation when the Bitcoin price fell below $100,000. Over $3Bn of longs were liquidated between November 13 and 21, leaving fewer active participants in the market.

(Source: Coinglass)

The thing is, it could get worse if bears press on, reclaiming $85,000. If politics improve, it could come as a reprieve not only for Bitcoin but also for top Solana meme coins. Before then, gold, which is viewed as safer than any digital asset, could soar to fresh all-time highs. This is also not forgetting that Bitcoin is caught between being a “digital gold” and a “tech stock”. In the current economic uncertainty, Bitcoin is behaving more like a tech stock. As such, it will always suffer whenever the stock market take a beating.

Still, on X, traders are confident. One notes that the Bitcoin price will snap higher now that its gap with the global liquidity index is at one of its widest points in history. At spot rates, the analyst said the BTC USD price is trading at a massive -25% discount relative to the global M2 liquidity.

This is the biggest its ever been.

Right now, Bitcoin is trading at over a 25%+ discount to its fair value based on liquidity.

This is extreme.

Sometimes Bitcoin is above, sometimes it is below…

But it always catches back up to the mean.

We can observe that in the last… pic.twitter.com/WY0gLnno6K

— Sykodelic (@Sykodelic_) January 22, 2026

Historically, when this happens, traders often expect an “explosive” catch-up move as the digital gold moves back to fair value.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin Price Liquidity Dries Up as $1Bn ETF Outflows Shake Prices appeared first on 99Bitcoins.