Bitcoin and gold are back, well, not yet, only gold for now. But Iran’s rial sinks to fresh record lows, and confidence in fiat currencies continues to fray, and we are again asking questions. In the middle of those sits a developing US crypto bill, built around the proposed Clarity Act, that could reshape how crypto is treated in America.

The draft US crypto bill surfaced just as traditional safe havens surged. Gold and silver pushed to new highs, while Bitcoin is gliding below recent resistance. But, again, SEC Chair Paul Atkins called this week a big week for crypto, a public signal that regulation may finally move from enforcement to structure under the Clarity Act framework.

This is a big week for crypto – Congress is on the cusp of upgrading our financial markets for the 21st century.

I am wholly supportive of Congress providing clarity on the jurisdictional split between the SEC and the @CFTC. pic.twitter.com/NtDWRW85kL

— Paul Atkins (@SECPaulSAtkins) January 12, 2026

US Crypto Bill Progress and the Clarity Act Debate

The Clarity Act is designed to do something the market has waited years for. A defined jurisdiction.

Under the current US crypto bill, most digital assets would be overseen by the CFTC as commodities, rather than defaulting to SEC scrutiny. This shift alone changes how projects operate and how investors assess risk.

JUST IN: US Senate releases crypto market structure ‘Clarity Act’ draft bill. pic.twitter.com/a6bGaMKKDq

— Bitcoin Junkies (@BitcoinJunkies) January 13, 2026

Senator Cynthia Lummis has also added momentum with related language protecting Bitcoin developers from being classified as money transmitters. For us, this matters. It removes legal uncertainty without watering down oversight, and supporters of the Clarity Act think that clear rules are what attract serious capital.

Hearings are expected to happen this week and could refine details, especially around DeFi protections and stablecoin exclusions.

DISCOVER: 10+ Next Crypto to 100X In 2026

Bitcoin, Gold, and Precious Metals Move Side by Side

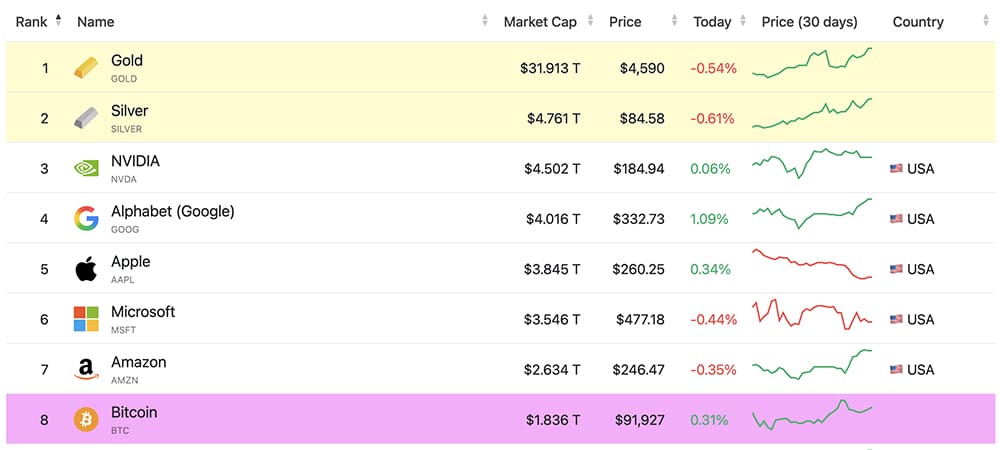

While lawmakers argue policy, markets have cast the vote. Gold reached a remarkable $4,600 per ounce, silver climbed to above $85, and together their market value now exceeds $15 trillion. Against that scale, Bitcoin, the digital gold, still looks small at around $1.8 trillion, but comparisons are growing faster as institutions buy.

(source – companiesmarketcap)

Bitcoin is now at $91,800 and remains above the 200-day EMA, a level we should watch closely. Recent liquidations topped $250 million, mostly from long positions, yet on-chain data shows long-term holders are holding. The resilience keeps the “Bitcoin to follow gold narrative” alive, even as volatility remains higher than metals.

What Comes Next for Bitcoin and Crypto?

Technical signals are mixed but improving. RSI divergence and a stabilizing MACD show that downside pressure is fading. A break above $94,300 could open a path toward $95,000 or even $100,000.

(source – TradingView)

Whether that happens may depend on charts and on Washington. Progress on the US crypto bill and acceptance of the Clarity Act could be the catalyst Bitcoin needs. Altcoins remain secondary for now, but if Bitcoin steadies, rotations may follow. For the moment, clarity is what the market is watching. Stay bullish.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Warren Vs Trump: Crypto Retirement Plans Spark SEC Fight

Following President Trump’s now-public spat with SEC Chair Jerome Powell, Senator Elizabeth Warren has pressed the SEC to step in after the Trump administration pushed crypto deeper into US retirement plans.

Key figures in Washington are at each other’s throats after the Department of Justice announced it is investigating Powell, and the SEC chair responded with a fiery retort, calling out President Trump for his heavy-handed tactics. Senator Warren inserting herself into the narrative comes as no surprise due to her longstanding agenda against crypto.

During the latest US political drama, Bitcoin held steady above $90,000 and is currently trading at $91,800, up around 0.4% in the past 24 hours. Until $90,000 is lost or $94,000 is breached, BTC USD remains locked in a tight range designed to chop leverage traders in both directions.

The broader crypto sector remains stable, with privacy tokens surging and propping up the market as the total combined market cap rose +0.5% overnight to remain above $3.2 trillion, per CoinGecko.

(SOURCE: CoinGecko)

Read the full story here.

The post Crypto Market News Today, January 13: US Crypto Market Clarity Act Bill Draft Unveiled as Silver and Gold Hit Highs | Bitcoin Next? appeared first on 99Bitcoins.