📉 Crypto Momentum: Weekly Review (Jan 23–30, 2026) — Market Crash & Portfolio Real Talk

Crypto took a brutal hit this week with global market cap plunging ~10–12% (from ~$3.3T to $2.9T), liquidations at ~$2B, and BTC dominance ticking up to ~56%. Gold holds as a safe haven despite its own pullback. Here’s the raw breakdown — staying transparent even in the red. 😎

📊 Weekly Market Shifts

Sharp correction across the board.

Coin Weekly Change Key Levels Notes BTC -10% 91k → 82–83k USD Bear channel under 50-day EMA ETH -8% 2.911$ → 2.800$ Following BTC, 2.600$ support SUI -6–8% Relative resilience L1 strength shining AERO -18% Deep oversold DeFi volatility crush XRP -8% Stabilizing Regulatory tailwinds

Gainers: BERA/MON (+3–5%). Losers: Altcoins like CAKE/XMR (-12%).

🔍 Technical Analysis Breakdown

BTC: RSI(14W) ~32 (oversold), MACD negative crossover, ADX ~38 (strong downtrend), CCI -150 (extreme oversold). Support at 81k; rebound possible from Fear & Greed at 28.

ETH: RSI ~30 (oversold), MACD sell, ADX 32 (downtrend) — tied to BTC.

SUI: RSI ~33 (exhaustion), MACD bearish but ticking up.

AERO: RSI ~28 (deep oversold), ADX 35 — heavy pressure.

XRP: RSI ~33 stabilizing, long-term boost from regs.

🌍 Global Crypto Headlines

ETF outflows: BTC -$2B+ amid strong USD and Trump trade pressures.Positives: HK stablecoin licenses, Bitmine’s $100M ETH buy, SUI ETF rumors.Macro: Geopolitics + Fed signals = volatility ahead.

🪙 Gold Analysis

Gold dipped from ~$5,300 to $5,075/oz (-4%), but +17% monthly. RSI rebounding, MACD buy signal, ADX uptrend targeting $5,550. Still the ultimate hedge. 📈

💼 Honest Portfolio Update: No Sugarcoating the Dip

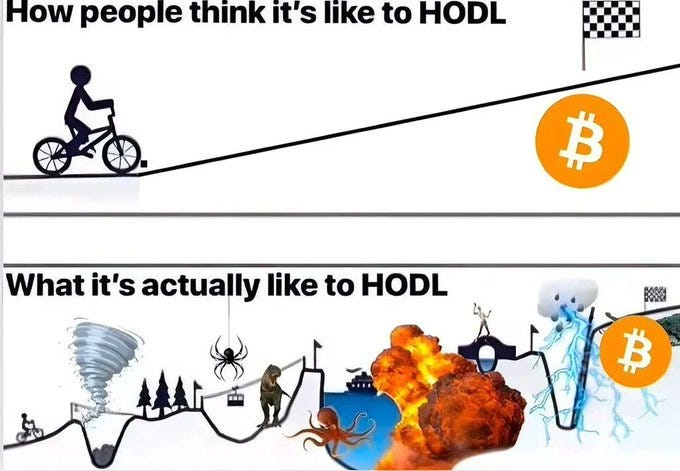

Markets crash, portfolios feel it — long-term HODL mindset intact. Here’s the damage across platforms:

BITPANDA: Down $30 (stable thanks to ETFs/gold). BITPANDAVFAT: -$120 (heavy ETH exposure), but +$15 fees (harvesting half).KRYSTAL: -$50, +$3 fees (harvesting).GAMMASWAP: -$9 (ETH volatility play).PENDLE: +$3 (stablecoin positions).MOONWELL: -$23, AAVE: -$20, NAVI: -$10. LTVs dipped but safe — no liquidations.TURBOS: -$5, out of range (watching for rebound).CETUS: -$20 balance, +$2.25 fees (relooping); vaults mixed but rewarding.GMX: +$5 profit via hedge strategy.BEEFY: -$478 (market-driven; core holding).

📊 Beefy Portfolio Dashboard

Metric Value Total Deposits $8,665 Vaults 11 Accrued Yield $1,817 Est. Daily Yield $8.73 🚀 Annual Run-Rate ~$3,180 Strategy Yield-first (CLM + vaults)

What’s Working 🟢:

Strong daily yield ($8.73).Diversified across chains/protocols.Stable vaults absorbing shocks.

Fixes Needed 🔴:

Negative PNL on most CLM (AERO drag too heavy — closing that vault, rotating to stables until rebound).

🧠 Key Takeaway: Fear = Opportunity

Market’s breathing — panic is your entry signal. Track momentum, skip the FUD. DeFi shines in dips when yields compound. Closing AERO for now, but strategy’s solid long-term.

Final Score: Resilient amid chaos. What’s your move in this correction? Drop thoughts below! 👇 #CryptoPortfolio #DeFiYields #BitcoinDip

🛡️ DeFi Yields Survive 10% Crash: $8.73 Daily from Beefy Vaults Amid BTC Bloodbath was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.