Today, crypto markets are stuck in an awkward pause with so much fud-toned news. Bitcoin USD price is holding its breath, the gold chart keeps running, and each one of us is glued to the incoming FOMC news. With the dollar losing altitude, risk assets are recalibrating.

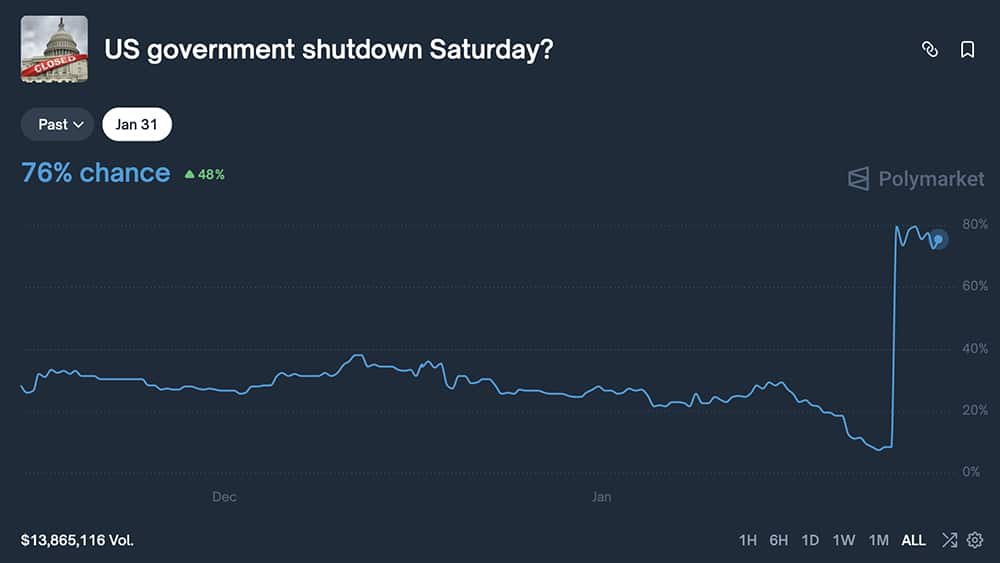

Under the surface, Polymarket bettors are assigning nearly a 76% probability to a US government shutdown by January 31. And legislative momentum around the US Crypto Clarity Act has slowed, keeping institutions cautious. Now, is there even enough liquidity for the market today?

(source – Polymarket)

The Federal Open Market Committee meeting also delivered no surprises on paper, yet. Rates were held steady at 3.50%–3.75%, brushing aside expectations of an early cut.

Meanwhile, dollar weakness is playing some part in the current market condition. The USD index slipped by almost 3% to 96.09 this week, and more than 10% in the last 12 months. Today, though, the drop is likely fueled by rumors and whispers of yen intervention.

(source – TradingView)

For macro cycles veterans, these are familiar conditions. Before the Plaza Accord in the 1980s, currencies weakened well before official coordination.

FOMC News Reshapes Crypto Movement Today

Safe-haven flows are no longer subtle as Gold USD smashed through an all-time high today of $5,280 per ounce, outperforming the S&P 500’s total return by more than 100% over comparable periods. Most crypto news today is mentioning gold alongside equities as capital hedging macro risk tied to FOMC news.

Even stablecoin issuers are leaning into the same narrative. Tether now reportedly holds over 140 tons of gold, worth $24 billion in current price, more or less, stored in Switzerland. That stash is larger than the reserves of several countries, reinforcing gold’s relevance.

JUST IN: Tether now holds over 140 tons of gold worth $23 billion, the largest known non-sovereign gold stash in the world, stored inside a nuclear bunker. pic.twitter.com/QMZGVK3Tue

— Watcher.Guru (@WatcherGuru) January 28, 2026

At the same time, Bitcoin USD trades around $89,000, up by a litle 1.2% on the day. Comparing gold to Bitcoins, or even USD? You simply cannot compare them. Yes, gold spent years consolidating before exploding higher, while Bitcoin sprinted first and paused later. With gold sitting at a $36 trillion market cap, some argue that crypto and Bitcoin USD still have room to play catch-up; they just need the FOMC news today to turn liquidity-friendly.

Gold is pumping short-term after a decade of accumulation. Bitcoin is accumulating short-term after a decade of Pumping.

DISCOVER: 10+ Next Crypto to 100X In 2026

Bitcoin and Gold USD Diverge, Then Converge?

From a technical angle, Bitcoin USD remains in a medium-term downtrend, facing resistance near $89,250 and finding support closer to $85,000. Momentum traders might see the potential for a higher low, especially if the dollar continues to weaken after key news on FOMC milestones.

Crypto news today supports a cautiously constructive backdrop, with the total crypto market cap rising 1.49% to $3.02 trillion as Bitcoin dominance dipped slightly. On-chain activity shows that Solana-based platforms like Pump.fun are briefly overtaking Hyperliquid in daily revenue, proof that degens are still degening, as they change lanes from derivatives trading to memecoining.

(source – CoinGecko)

Bitcoin mining stocks like Applied Digital jumped 14%, IREN gained 9%, and some followed suit. The Crypto Fear & Greed Index also improved, climbing from extreme fear into the fear zone.

Bernstein’s call for tokenization as a game-changer adds a longer-term frame. Crypto news today remains tethered to macro gravity, and FOMC news pressures the dollar. Gold keeps leading the dance, and Bitcoin USD waits.

Bernstein (Gautam Chhugani): tokenization is a “game changer” because it starts touching the core plumbing of finance: origination, financing, and trading across credit and equities. The thesis isn’t hype, it’s friction: platforms that compress costs and cycle times can… pic.twitter.com/ytYdGnyv3K

— PBG (@PBGtoken) January 27, 2026

Crypto is being shaped by one theme today: news uncertainty. TL;DR, Bitcoin USD pumps a bit, but not at a happy point yet, while gold pushes into record territory.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Australian Court Slaps Crypto Firm With Fine Over Misleading Claims

Unfortunately, crypto cannot thrive without regulation. Compliance with existing laws provides the necessary plumbing for growth and smooth operations. The US and Europe are keen on drafting laws to regulate this multi-trillion-dollar industry, and regulators across the world now move faster and hit harder when marketing crosses the line.

Recently, an Australian federal court fined crypto firm BPS Financial after finding it misled investors about a token tied to its platform. The ruling, finalized in late January 2026, is a clear signal that the “authorized representative” loophole and aggressive marketing claims will no longer fly, especially in Australia.

Even after this ruling, the Bitcoin price is still capped below $90,000. Traders are upbeat, expecting the digital gold to follow gold and precious metals. However, before this phase, buyers must clear $90,000 and $95,000.

Read here.

Ethereum Treasury ETHZilla Sells ETH for Jet Engines

ETHZilla, the Ethereum-centric treasury outfit, just pulled off something genuinely unexpected: it offloaded roughly $114 million worth of ETH to snap up two CFM56-7B24 jet engines for $12.2 million. The purchase went through a fresh subsidiary called ETHZilla Aerospace LLC, and those engines are already leased out to a major airline, delivering steady monthly cash flow.

There’s even a built-in buy-sell clause letting either side move the assets for $3 million apiece once the lease wraps.

https://twitter.com/0xgeegee/status/2015237659028009305?s=61

At first glance, it feels off-script. Most crypto treasuries treat their tokens like sacred reserves, stacking them high rather than trading them for heavy machinery. Yet here ETHZilla is, swapping digital assets for literal airplane parts.

This fits a wider push toward the tokenization of real-world assets. Big finance wants blockchain rails without the wild price swings of pure crypto.

Read the full story here.

Tom Lee’s BitMine Just Made Its Biggest ETH Buy Ever

Yesterday, on January 26, Tom Lee-backed BitMine made its largest-ever Ethereum purchase, adding aggressively to its ETH holdings. Replicating Strategy’s plan, BitMine has been aggressively buying ETH over the last few months. As of late January 2026, the company is the largest holder of ETH among all public firms.

The ETH USD price reacted positively to the news. Although a technical candlestick arrangement may favor sellers in the short term, buyers are pushing on. The second most valuable coin is trading above $3,000 at press time, adding +3% in the last 24 hours.

Overall, the bounce can be seen as a positive development and a vote of confidence for ETH. With BitMine resuming its aggressive buying, it is a signal that the big boys could be warming back up to Ethereum after a long stretch of caution.

Read the full story here.

The post Crypto Market News Today, January 28: USD Index Dropping as We Wait For FOMC Results, Bitcoin to Follow Gold? appeared first on 99Bitcoins.