Solana price inched back toward $127 on Tuesday as record staking numbers helped steady the market after last week’s drop.

The token traded near $127 after a +3% gain in the past day through January 28. CoinGecko data showed spot volume close to $3.9Bn.

The move came after SOL slipped into the low-$120s, where buyers stepped in and slowed the decline.

DISCOVER: Top Solana Meme Coins to Buy in 2026

What Does Record SOL Staking and $7.6B Futures Open Interest Signal for Solana’s Market Strength?

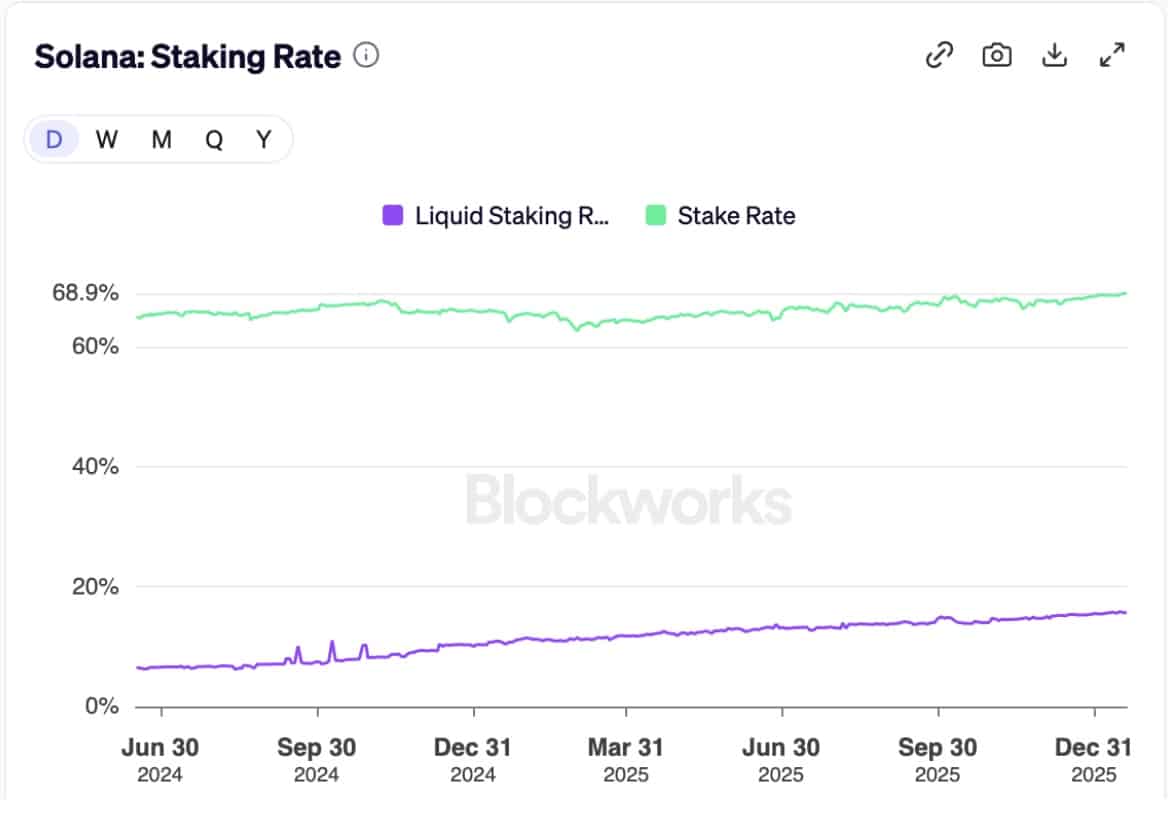

Staking activity stayed strong. SolanaFloor, using Blockworks data, reported that more than 425.7M SOL is now staked.

That’s the highest level ever measured in SOL terms. The network’s stake rate sits just above 68.9%.

The report also said that about 15.64% of SOL is now staked through liquid staking platforms.

Those tokens can still move across DeFi, which keeps activity high even when the broader market cools.

SolanaFloor also noted rising activity in institutional products.

Marinade Select’s SOL-denominated TVL climbed past 1.6M SOL in January, an increase of about 87% since July 2025.

CoinGlass showed SOL futures open interest at roughly $7.66Bn, with about $9.65Bn in futures volume over the past day. Solana’s market value stayed near $72.06Bn.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

Solana Price Prediction: Is Solana Preparing for a Bigger Move After Holding the $120–$125 Support Zone?

Solana price is still trading close to a major long-term support zone after a sharp pullback. Price continues to hover above the $120–125 band on the three-day chart.

This area has held as a strong demand level several times in the past year, and the latest move suggests buyers stepped in again after last week’s pressure.

The chart signals a broader corrective phase, not a break in the overall trend. SOL remains inside its long-term structure, with this retracement cooling off momentum after the push toward $240.

Sharp retracement off of key support & looking fine.

A move lower? GOOD.

Deep value is where winners are made.

I will ONLY be selling at severe over valuations. pic.twitter.com/7GTjKJlLEO

— James (@JamesEastonUK) January 27, 2026

Volatility has also thinned out as price tightens near support. That kind of compression often leads to a larger move once the market picks a direction.

Momentum indicators show the selling pressure is starting to cool.

The RSI is still sliding inside a downward channel, but it hasn’t touched the levels that usually mark panic or exhaustion. That tells traders the market may be slowing its decline.

Analyst James Easton sees the pullback as healthy. “Sharp retracement off of key support and looking fine,” he said. “A move lower? Good. Deep value is where winners are made.”

He also noted that he only trims positions when prices become “severely overvalued,” a sign he still expects strength in the long run even with the current weakness.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Key Takeaways

Solana inched back toward $127 on Tuesday as record staking numbers helped steady the market after last week’s drop.

CoinGlass showed SOL futures open interest at roughly $7.66Bn, with about $9.65Bn in futures volume over the past day. Solana’s market value stayed near $72.06Bn.

The post Solana Price Rises +3% While Staking Hits Record Highs – Is $126 the Floor appeared first on 99Bitcoins.