The Crypto Cycle Nobody Escapes – Learn the 4 Phases

Every crypto investor thinks they’re different — until the market proves otherwise.

No matter how smart you are, how early you think you entered, or how strong your conviction feels, every participant in crypto is pulled through the same market cycle. Some ride it intentionally. Most are dragged through it emotionally.

This is the crypto cycle nobody escapes.

If you’ve ever:

Bought near a top after “this time is different”Panic-sold during a brutal drawdownWatched a dead-looking token suddenly 10x without youWondered why the same mistakes repeat every cycle

Then this insightful read will change how you see crypto forever.

In this guide, you’ll learn the 4 phases of the crypto market cycle, how to identify where we are right now, and how professionals position themselves before narratives go mainstream.

What Is the Crypto Market Cycle?

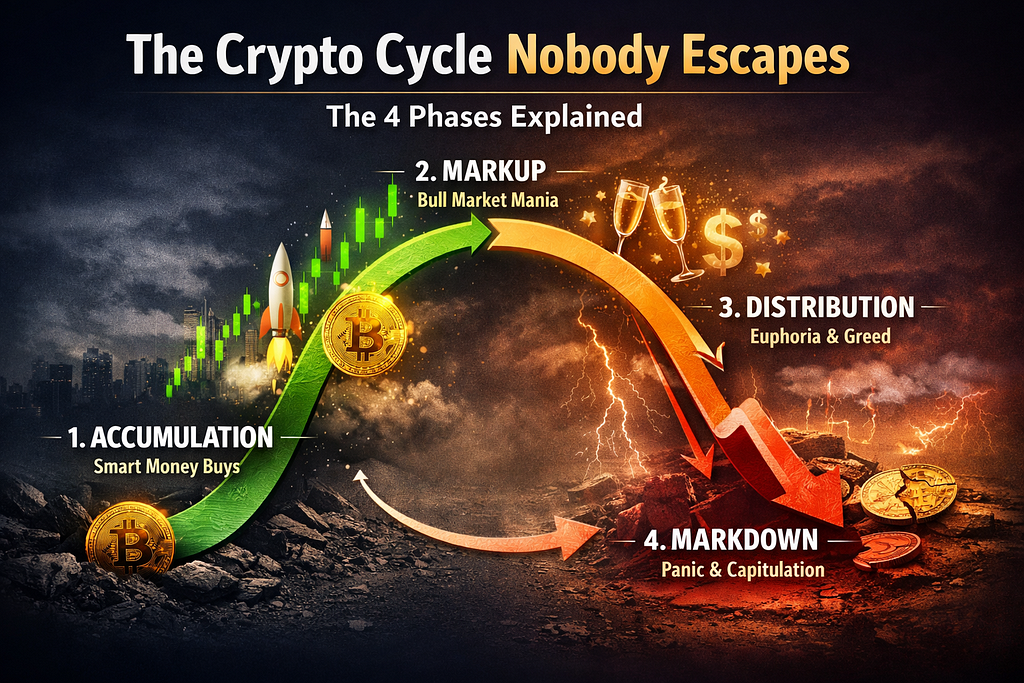

The crypto market cycle is a repeating pattern of price action, liquidity flow, and investor psychology that moves through four distinct phases:

AccumulationMarkup (Expansion)DistributionMarkdown (Capitulation)

These phases repeat across:

BitcoinEthereumAltcoinsNFTsDeFiMeme coins

The names change. The narratives change.

Human behavior does not.

Why the Crypto Cycle Always Repeats

Crypto feels chaotic, but its cycles are driven by three predictable forces:

1. Liquidity

Crypto is highly sensitive to:

Interest ratesDollar liquidityRisk appetite

When liquidity expands, crypto rallies.

When liquidity contracts, crypto collapses.

2. Narratives

Each cycle has a story:

2017: ICOs2021: DeFi, NFTs, Web32024–2025: AI tokens, RWAs, Bitcoin ETFs

Narratives attract capital after early positioning has already happened.

3. Psychology

Fear, greed, disbelief, euphoria, despair — the emotional arc never changes.

Understanding the cycle means understanding your own behavior before the market exploits it.

The 4 Phases of the Crypto Cycle (Overview)

The 4 Phases of the Crypto Cycle (Overview)

Let’s break each phase down in detail:

Phase 1: Accumulation (Where Fortunes Are Made)

Accumulation is the phase where prices stop falling, volatility dries up, and interest disappears.

It’s also where smart money quietly positions.

Key Characteristics of Accumulation

Long sideways price actionExtremely low sentiment“Crypto is dead” headlinesMinimal media coverageLow trading volume

This phase feels boring, painful, and hopeless — which is exactly why it works.

Investor Psychology

Retail is traumatized from the last crashMost participants swear they’ll “never buy crypto again”Attention shifts to stocks, real estate, or savings accounts

What Smart Money Does

Accumulates Bitcoin firstSlowly builds core positionsResearches next-cycle narrativesBuys when nobody is watching

Rule of the cycle:

If it feels safe, it’s already late.

Real Example: Bitcoin 2019–2020

After the 2018 crash:

Bitcoin traded sideways for monthsSentiment was historically bearishInstitutions quietly accumulated

By the time headlines turned bullish, the accumulation phase was already over.

How to Identify Accumulation in Real Time

Look for:

Price flattening after a prolonged downtrendDecreasing volatilityNo excitement on social mediaProjects building quietly with no hype

Accumulation doesn’t reward excitement — it rewards patience.

Phase 2: Markup (The Expansion Phase Everyone Wants)

The markup phase is where prices break out, trends form, and crypto “comes back to life.”

This is the phase most people think they want — but few position correctly.

Key Characteristics

Higher highs and higher lowsIncreasing volumeRising social media engagementNew narratives gaining tractionRetail slowly re-entering

Investor Psychology

Disbelief turns into curiosity“Is this a dead cat bounce?”Gradual confidence builds

This is where early adopters look like geniuses.

What Smart Money Does

Holds core positionsRotates into higher-beta assetsLets winners runAvoids emotional trading

What Retail Does

Buys breakouts lateChases green candlesIncreases leverageBelieves “this time is different”

Markup Is Not the End

Most investors confuse early markup with a market top.

In reality, markup can last months or years, but only if liquidity continues expanding.

Phase 3: Distribution (The Silent Exit)

Distribution is the most dangerous phase because everything looks perfect.

Prices are high. Confidence is extreme. Narratives feel unstoppable.

This is where wealth quietly transfers from late buyers to early holders.

Key Characteristics of Distribution

Sideways price action near highsIncreasing volatilitySharp rallies followed by sudden drops“Buy the dip” cultureMaximum media coverage

Investor Psychology

EuphoriaOverconfidenceFOMOSocial proof everywhere

People stop asking if they should buy — only what to buy.

Classic Distribution Signals

Celebrities endorsing cryptoFriends and family asking for adviceGuaranteed profit claimsLeverage usage exploding“Supercycle” narratives

When everyone is bullish, risk is highest — not lowest.

What Smart Money Does

Sells into strengthReduces exposureRotates to stable assetsStops posting online

What Retail Does

Buys dips aggressivelyDoubles down on losersBelieves corrections are “healthy”

Distribution feels like success — until it suddenly doesn’t.

Phase 4: Markdown (Capitulation & Reset)

Markdown is where optimism dies.

Prices fall fast. Liquidity vanishes. Narratives collapse.

This phase exists to reset expectations and transfer conviction.

Key Characteristics

Sharp drawdowns (50–90%)Exchange failures or regulatory shocksMedia declaring crypto “finished”Influencers disappearingForced liquidations

Investor Psychology

PanicDenialAngerCapitulation

This is where most people:

Sell at the worst possible timeWalk away permanentlyMiss the next cycle entirely

Why Markdown Is Necessary

Markdown:

Flushes leverageClears weak handsResets valuationsPrepares the next accumulation phase

Every bull market is born from despair.

The Emotional Cycle of Crypto (Why You Feel Trapped)

The crypto cycle mirrors the emotional market cycle:

OptimismExcitementThrillEuphoriaAnxietyDenialPanicCapitulationDepressionHope

Most investors enter at step 4 and exit at step 8.

Cycle-aware investors do the opposite.

Why Most People Lose Money Every Cycle

Not because they lack intelligence — but because they lack frameworks.

Common mistakes:

Confusing narratives with timingBuying emotions instead of phasesOverexposing during distributionUnderexposing during accumulation

Knowledge of the cycle is a competitive advantage.

How to Use the Crypto Cycle Strategically

You don’t need perfect timing — you need phase awareness.

Simple Cycle Strategy

Accumulate when sentiment is deadHold during expansionReduce risk during euphoriaPreserve capital during markdown

Even partial adherence dramatically improves outcomes.

Where Are We in the Crypto Cycle Right Now?

Cycle positioning changes — but the framework remains constant.

Ask yourself:

Is liquidity expanding or tightening?Are narratives emerging or peaking?Is retail early, late, or exhausted?

The market always tells the truth — eventually.

Conclusion: You Can’t Escape the Cycle — But You Can Master It

The crypto cycle doesn’t care about your beliefs, conviction, or intelligence.

It rewards:

Patience over excitementDiscipline over hypeAwareness over prediction

You will experience every phase — the only question is whether you recognize them in time.

If this article helped reframe how you see crypto, clap it, save it, and share it — because the next cycle always begins when most people stop paying attention.

The Crypto Cycle Nobody Escapes: Learn the 4 Phases was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.