US home prices are starting to look like a tradable event. Crypto prediction markets are moving beyond politics and sports and into housing.

On 5 January 2026, Polymarket and Parcl said they are launching prediction markets based on real estate. Polymarket is a crypto prediction market platform. Parcl provides real-time home price data. Together, they will use Parcl’s daily home-price indices to settle these new contracts.

The first markets will focus on big US cities. Traders can bet on whether a city’s home price index will go up or down over a month, a quarter, or a year.

There will also be markets tied to specific price thresholds on set dates.

Each market will link to a Parcl page that shows the final settlement value, some history, and how the index works. The goal is to make the results easy to verify and cut down on disputes.

“Prediction markets work best when the data is clear, and the outcome can be verified without debate,” Polymarket Chief Marketing Officer Matthew Modabber said in the release.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Is Real Estate Becoming a Major Category in Crypto Prediction Markets?

Parcl CEO Trevor Bacon said the partnership marks a step toward making real estate “a major category” in prediction markets.

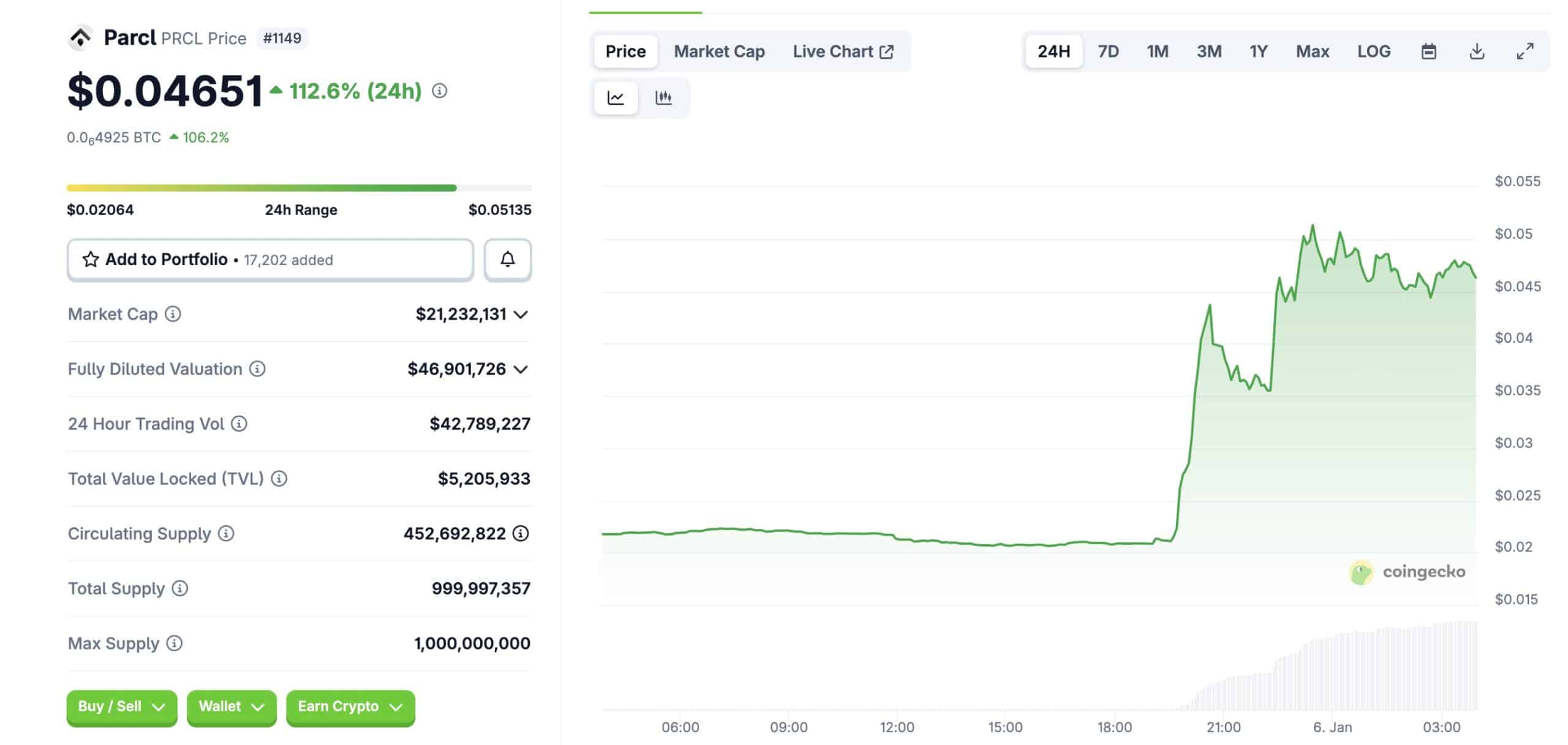

The announcement also moved tokens tied to housing data. Parcl’s PRCL token jumped sharply in the past 24 hours.

CoinGecko data showed a triple-digit gain of about +112% and a clear rise in trading volume.

The move comes as prediction markets widen into themes that sit closer to financial assets. It also arrives at a moment when Polymarket is drawing more interest from traditional finance.

According to Reuters, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, said it planned to invest up to $2Bn in Polymarket in October.

That deal valued the company at about $8Bn before new investment, and signaled a possible path back into the US market as regulators rethink the space.

Supporters say housing-linked event contracts could give traders, and even homeowners and analysts, a faster way to express a view on price direction.

DISCOVER: 20+ Next Crypto to Explode in 2026

How Do Housing Prediction Markets Differ From RWA Tokenization?

They also see it as a way to gain exposure to local real estate trends without buying property or taking on mortgage debt.

Unlike real-world asset (RWA) tokenization, where ownership shifts onto a blockchain ledger, these products work more like derivatives.

Traders aren’t buying pieces of a home. They’re taking a position on how an index moves.

Even so, the launch sits next to a wider shift toward putting traditional assets on-chain.

RWA.xyz now tracks about $19.25Bn in tokenized assets and roughly $298Bn in stablecoins, which still act as the main settlement layer for most tokenization projects.

Standard Chartered expects this category to expand fast. Its forecast, cited by Reuters Breakingviews, puts tokenized RWAs at around $2 trillion by 2028.

That figure alone shows how quickly tokenization is entering mainstream finance.

Parcl said it may also bring Polymarket’s market-implied probabilities into its analytics dashboard.

If it does, traders would see sentiment signals next to housing data as an early look at what blended prediction and pricing tools might become.

The companies plan to release these markets in stages, starting with cities that already see strong trading activity.

And that brings the immediate test: whether real liquidity shows up in housing contracts, and how regulators respond to event markets tied to real-estate indicators as this space grows.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Key Takeaways

“Prediction markets work best when the data is clear, and the outcome can be verified without debate,” Polymarket Chief Marketing Officer Matthew Modabber said.

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, said it planned to invest up to $2Bn in Polymarket in October.

The post Prediction Markets Come To Real Estate: Will Crypto Shake Up Property Speculation? What About RWAs? appeared first on 99Bitcoins.