Moonrock Capital CEO, Simon Dedic, is hyper bullish on crypto. He thinks that the sector is on the verge of its most transformative era yet, in what he termed an institutional supercycle. Per Dedic, the crypto sector is moving beyond its early adopter niche into mainstream acceptance.

In his post on X on 8 December 2025, he argued that the crypto sector is entering a “much bigger chapter” where institutional capital, regulatory clarity, and macroeconomic factors will drive growth as opposed to its traditional four-year cycles.

The last 10 years were the degen supercycle, driven mainly by infrastructural plays that laid the foundation for crypto.

The next 10 years will be the institutional supercycle, driven by building on top of that foundation and creating truly productive user aggregators.

You…

— Simon Dedic (@sjdedic) December 8, 2025

This transition, Dedic argued, is the institutional supercycle that will last for the next 10 years, well into 2035. This sentiment, however, isn’t new.

Earlier, in October, when the crypto market was booming, BTC was at its Zenith and ETH looked like it would breach $5k, analysts had predicted that new regulations, such as stablecoin frameworks, could pump up to $4 trillion in institutional funds for crypto markets, marking a true coming of age of the sector and its transfornation as a core pillar of modern finance.

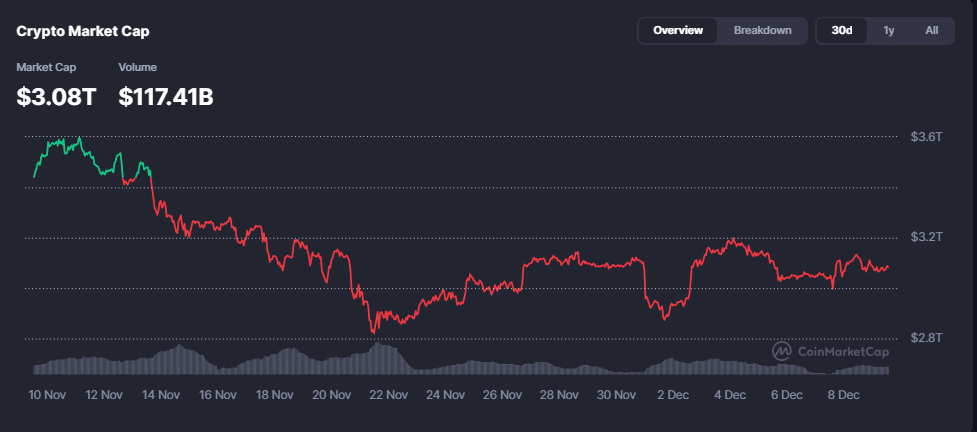

Since then, the broader crypto market has dumped hard and hasn’t really recovered all that much. Major coins are still trading way below their ATH, and the broader crypto market has declined from over $4.15 trillion in October, bottoming out at $2.82 trillion, to now sitting at $3.07 trillion.

The market now hinges on the Fed’s (Federal Reserve) decision to go ahead with the rate cut in December or to skip it.

(Source: CoinMarketCap)

In this context, WAGMI (We’re All Gonna Make It) sounds like a coping mechanism that crypto nerds shill to themselves with half their portfolio now in the red. However, there are still chances that the story could flip based on the Fed’s decision to cut rates.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Institutions Go All-In: Can Crypto Become Global Finance?

To be honest, institutions have gone in pretty hard on crypto and have even spiralled off new businesses such as DATs (Digital Asset Treasury) that have then gone on to become institutions themselves.

Michael Saylor’s Strategy holds the most Bitcoin ever, and Bitmine holds the most ETH ever. If the institutional supercycle plays out, crypto would evolve from a speculative asset to a global financial infrastructure.

(Source: BitcoinTreasuries.Net)

Countries, corporations, and individuals alike would participate in a system where digital assets are as common as traditional deposits. For WAGMI believers, this is the ultimate payoff: a future where crypto isn’t fringe, but foundational.

And to the credit of the WAGMI narrative, countries have been warming up to crypto, with several countries now thinking of having a crypto reserve and some actually implementing it.

BULLISH: Kazakhstan to build “CryptoCity” and form a National Digital Asset Fund. pic.twitter.com/Yae1g7uymF

— Coin Bureau (@coinbureau) September 9, 2025

But not everyone is convinced, including Dedic himself. He has himself acknowledged a 20% chance of the industry remaining stuck in its early-adopter phase. This could prolong the bear market.

Additionally, there is a 5% chance that crypto fails to achieve mainstream product-market fit altogether, rendering this whole 16-year exercise useless.

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

How To WAGMI The Institutional Supercycle?

For starters, Dedic doesn’t think that the 5% worst-case scenario is going to play out.

In what must sound like honeyed words to WAGMI believers, Dedic is convinced that the industry is already riding high on the first big waves of mainstream adoption thanks to what he calls “regulatory tailwinds, institutional adoption, and the accelerating fundamentals of our industry.”

How I see the market right now:

1) 75% probability: we’re about to finish crossing the chasm and enter the early-majority phase next year.

If that happens, the classic 4-year cycles are dead. The market will have matured and will increasingly correlate with macro cycles and… pic.twitter.com/hKm0CbtH2C

— Simon Dedic (@sjdedic) December 3, 2025

However, he also cautioned that the industry needs to grow with it. “The 4-year cycles and simple narrative chasing are dead,” he says. While “the on-chain online casino will always be part of our identity, it will shrink into a niche. It’s time for the industry to mature and start playing the serious game.”

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Key Takeaways

Simon Dedic predicts a decade-long crypto institutional supercycle driven by regulatory clarity

Institutions like Strategy and Bitmine already hold massive BTC and ETH reserves

Crypto adoption risks remain, with a 25% chance of stagnation or failure by 2035

The post “Much Bigger Chapter” Starting For Crypto Says Moonrock Capital Founder: How To WAGMI In Crypto Institutional Supercycle By 2035 appeared first on 99Bitcoins.