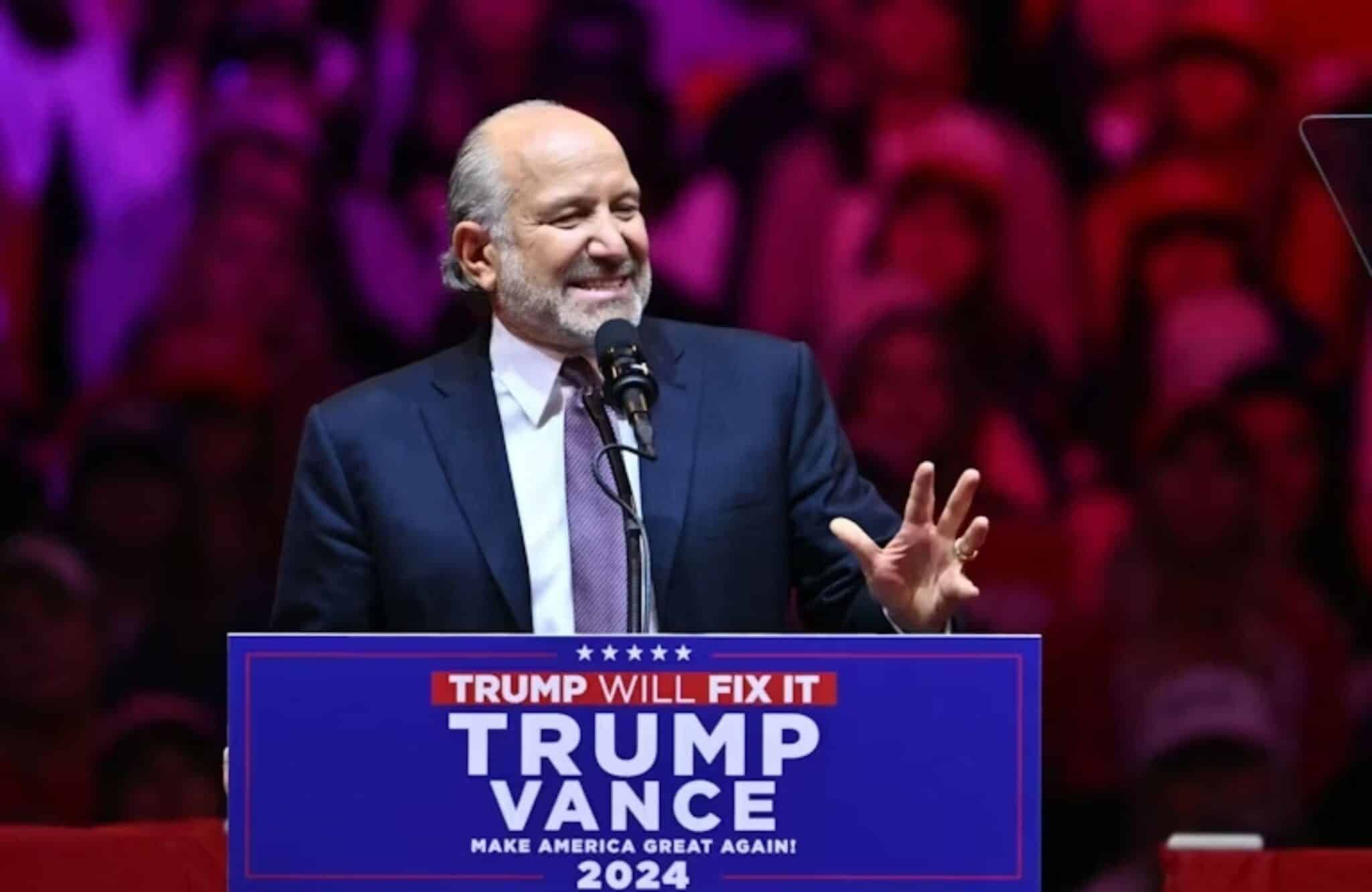

Donald Trump’s pick of Cantor Fitzgerald CEO Howard Lutnick for Secretary of Commerce has sent ripples through financial circles, especially among crypto enthusiasts – with many wondering Howard Lutnick’s Bitcoin impact and Howard Lutnick’s crypto policy influence.

Lutnick is a vocal supporter of digital assets. He personally owns Bitcoin

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

and Tether, and his company recently held a conference at which Michael Saylor spoke. Saylor discussed the Trump/Vance win and the idea of a Bitcoin strategic reserve.

Robert F. Kennedy Jr., Bitcoin advocate Anthony Pompliano, and crypto entrepreneur Gary Vee all voiced support for Lutnick.

(X)

What Howard Lutnick Means For Bitcoin

Howard Lutnick is not your typical Wall Street executive. Leading Cantor Fitzgerald, he’s been ahead of the curve on crypto, focusing on Bitcoin and Tether. Under Lutnick since 2021, the firm’s been steering Tether’s US Treasury and bond portfolios, proving his push to merge digital money with old-school finance.

In a recent statement, he reaffirmed his belief in Bitcoin’s potential, emphasizing, “Bitcoin isn’t just an American thing. It’s a global phenomenon.”

So what will a Howard Lutnick-led Department of Commerce look like for Bitcoin and crypto assets?

Let’s start with the crazy theories first.

Remember we don’t know exactly, and we’re thinking out loud. It’s possible that Lutnick could support Michael Saylor’s idea of the US government using Bitcoin to tackle the debt crisis.

Absent that, Lutnick has also talked about the US selling land rights to tackle the debt; since the federal government owns so much land, it does nothing with it.

Lutnick also means the US will get more serious about increasing US dollar hegemony through stablecoin usage abroad. Keeping the dollar strong relative to other fiat currencies would be crucial to the US, as well as buying and holding bitcoin.

At minimum, however, we might see more Bitcoiners get into positions of power, which means the state is neutralized as a threat, at least in the short to medium term.

The government has always been bitcoin’s “final boss,” and it seems like it could win that final battle during the Trump administration.

Lutnick’s belief in Bitcoin’s potential to drive market expansion will guide his actions in the Trump administration.

The bull case in all this is nothing less than Bitcoin unlocking the timeline of infinite easy winning and upside. Shitcoins may not stand a chance of keeping pace.

When Will Altcoin Season Rip?

We know what Lutnick will do for Bitcoin, but what about altcoins? The Bull runs here, but these altcoin bags are napping.

The immediate news is grim. Another day, another new ETH/BTC low.

We haven’t had an alt season since 2021, not even a mini one. When is Bitcoin’s dominance going to drop?

The bear case for alts is that most of the money coming into Bitcoin is from ETFs now, and that money can’t easily flow to alts. Do you think JP Morgan will sell its Bitcoin once it peaks to buy Pepe? LOL. Zoom out on the monthly charts. Dominance has been rising nonstop since April 2022.

Our bull case at 99Bitcoins is that alt season will only happen after Bitcoin maximizes its gains.

For now, because of people like Howard Lutnick, who is BTC Über Alles, we won’t see a true alt season until 2025. Until then!

EXPLORE: US Bitcoin Reserve: World On Precipice of BTC Arms Race

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Trump Tips Howard Lutnick For Commerce Secretary: What Will It Mean For Bitcoin? appeared first on .