Daily Crypto Trading Intelligence • Tuesday, February 17, 2026 • Powered by altfins.com

Bounce or Trap? Reading the Recovery Signals

The broad crypto market remains in a medium-term downtrend, but a cluster of oversold bounces and MACD crossovers are forming. Here is where the setups are — and where the traps lie.

01 — MARKET SNAPSHOT

Major Asset Overview

Live data from altfins.com screener. All five major assets remain below their SMA50 and SMA200.

Asset Price 7d Change RSI-14 Status BTC $67,376 −3.93% 34.2 Oversold ETH $1,970 −6.41% 33.9 Strong Down SOL $84.31 −2.82% 35.0 Oversold XRP $1.444 +0.48% 40.3 Neutral BNB $617.79 −2.91% 30.2 RSI Cross ⚡

02 — MARKET REGIME

Strong Downtrend with Oversold Bounce Potential

⚠️ BEARISH REGIME — Major Caps

BTC, ETH, SOL, BNB, and XRP are all locked in a medium-term Strong Down trend. All five trade well below their SMA50 and SMA200. BTC sits 19% below its 50-day MA ($83,526) and 33% below its 200-day ($100,110). ETH is down 28% from its SMA50. These are not minor pullbacks — this is a full correction phase.

◈ WATCH — Oversold Cluster Forming

RSI-14 readings for BTC (34.2), ETH (33.9), SOL (35.0), and BNB (30.2) are all at or near oversold territory. BNB has already crossed back above RSI 30 — historically a short-term buy signal. This cluster suggests short-term relief is possible, but should not be mistaken for a trend reversal.

Key context: Momentum has inflected bullish via MACD crossovers on several assets, but short-term recoveries are happening against a backdrop where virtually every major asset remains in a strong medium-term downtrend. Trade tactically — do not confuse a bounce with a bull market.

03 — ACTIVE TRADE SETUPS

Curated Signals from altfins Analysts

▲ BULLISH SETUPS

Bitcoin Cash (BCH) — Inverse H&S Breakout 🟢

$557.82 | +4.78% 7d

Broke out of Inverse Head & Shoulders pattern above $550 resistanceConfirmed breakout above the 200-day Moving Average — strongest large-cap setup right nowShort-term trend has flipped to UpPrice target: $625 | Stop loss: $524

Hyperliquid (HYPE) — Approaching Support 🟢

$29.56 | −5.55% 7d

One of very few assets with both short-term AND medium-term uptrends intactPullback toward $30 support is a potential swing entry opportunityStrong fundamentals: top revenue-generating blockchain, expanding into prediction markets & RWA contractsTarget: $40 | Stop loss: $27

Cosmos (ATOM) — Channel Down Breakout 🟢

$2.28 | +16.42% 7d

Bullish breakout from Channel Down with short-term trend flipping to UpSwing entry on pullback to $1.85 support (held in recent weeks)Targets: $2.50 then $3.00 | Stop loss: $1.65

Uniswap (UNI) — Catalyst + Resistance Breakout 🟢

BlackRock DeFi integration announcement as fundamental catalystNew fee-switch token buyback proposal approvedBroke above resistance. Target: $4.00 | Nearest support: $3.00

◈ OVERSOLD BOUNCE / NEUTRAL SETUPS

Bitcoin (BTC) — Approaching Resistance 🟡

$67,376

Extreme oversold bounce from $60K after RSI dropped below 20MACD inflected bullish — analysts expect consolidation $60K–$74K for several weeksResistance at $70K, then $74K. Do NOT chase — wait for confirmed breakout

AAVE — Approaching Resistance 🟡

~$120+

Bounced from oversold RSI ❤0 in $90–100 support zone, MACD crossover confirmedCould revisit $130–150 resistance. Top whale-held DeFi token

▼ BEARISH / HIGH CAUTION

Shiba Inu (SHIB) — Channel Down 🔴

Approaching $0.0000070 resistance in Channel Down — likely rejection zoneAll three trend timeframes are Down. Only suitable for short trades at resistance

Bitget Token (BGB) — Support Breakdown 🔴

Broke below $3.35, then $3.00, then $2.50 — cascading support failuresRSI dropped below 20 (extremely oversold). Possible dead-cat bounce toward $3.00. Avoid new positions

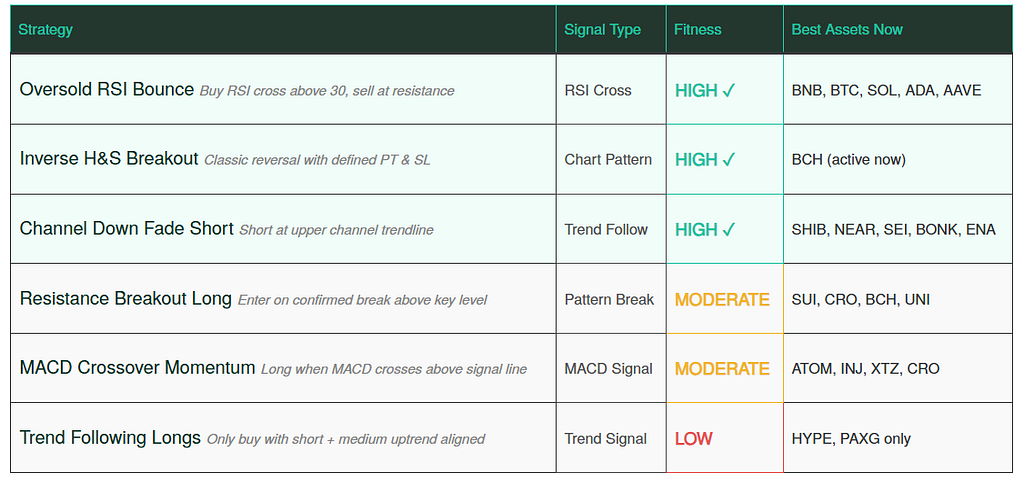

04 — STRATEGY PLAYBOOK

What’s Working in This Market

Source: altFINS

05 — SIGNAL DASHBOARD

Key Indicators at a Glance

Short-Term Trend Leaders

BCH — Up (8/10) ↑ | RSI 51.8HYPE — Up (7/10) ↑ | Short & Medium both UpATOM — Up (7/10) ↑ | RSI 59.0PAXG — Strong Up (8/10)ETH — Strong Down (0/10) 🔴BNB — Strong Down (0/10) 🔴

Top Weekly Gainers

PIPPIN +98.87% 🟢STABLE +26.20% 🟢ASTER +16.88% 🟢ATOM +16.42% 🟢ZBU +16.10% 🟢BCH +4.78% 🟢

Pattern Breakouts

BCH — Inv. H&S ✓ATOM — Ch. Down Break ✓SUI — Resistance Break ✓CRO — Resistance Break ✓HYPE — Ch. Down Break ✓BGB — Support Breakdown ↓ 🔴

06 — altFINS’ TAKEAWAY

Three Things to Act On This Week

1. TRADE — BCH Inverse H&S (Best Active Setup) 🟢

This is the cleanest high-probability setup in the current data. Confirmed breakout above $550 and the 200-day MA with a defined target ($625) and stop ($524). Risk/reward is favorable, short-term trend has confirmed the reversal. Size position accordingly and respect the stop.

2. MONITOR — HYPE Pullback to $30 Support 🟡

One of very few assets maintaining both short and medium-term uptrends. The current pullback is healthy. A hold or bounce at $30 with a bullish confirmation candle would be a textbook swing entry. Strong fundamental differentiation — real revenue, prediction markets expansion.

3. PREPARE — BNB RSI 30 Crossover Signal 🟡

BNB is showing the most significant RSI-30 crossover among large-caps. Resistance at $700–$750. This is a bounce trade, not a position trade — set your exit target before you enter.

Bottom line: The market is oversold but not yet reversing. The winning playbook is tactical, not strategic — take short-term bounce setups with defined stops, fade channel resistance in confirmed downtrends, and wait for medium-term trends to turn before adding longer-horizon exposure. Patience is a position.

All Data Provided in this article are available also via altFINS API and MCP server. More info

altFINS Market Update • altfins.com • Data: February 17, 2026

For informational purposes only. Not financial advice. Crypto trading involves substantial risk. Always do your own research.

altFINS – Crypto Market Update was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.