I spent one month tracking every Nigerian startup funding round from 2018 to 2025.

$4.17 billion. 293 companies. 528 deals.

The pattern that emerged shocked me

While founders chase Fintech (capturing 64% of all capital), the data reveals a hidden graveyard. Fintech has the WORST follow-on funding rate (40%) among all major sectors. Meanwhile, CleanTech startups — with just $228M raised — achieved 90% survival and 70% follow-on funding.

I analyzed every pivot, every acquisition, every shutdown. I mapped 72 subsectors across 8 years. I tracked which business models live and which struggle to survive.

Here’s what the numbers actually say.

The Survival Spectrum: Why Most Startups Fail

Across 72 subsectors and 293 companies, survival rates cluster into predictable tiers based on a simple formula: B2B + Essential Services + Recurring Revenue + Regulatory Tailwinds.

🟢 The 100% Survival Tier

The Pattern: Companies selling what businesses can’t operate without.

Examples:

HR & Payroll SaaS: SeamlessHR ($12.4M), PaidHR ($2.9M)Tech Skills Bootcamps (ISA Model): Decagon, Semicolon, Bildup AI — ALL operatingEnergy-as-a-Service (PAYG): Rensource ($44.5M), Watt ($29M) — ALL 5 operatingDigital Identity & RegTech: Seamfix, YouVerify, Prembly — 100% survival (CBN KYC mandate)Pharma Supply Chain: Remedial ($17.4M), Field Intelligence, DrugStoc — ALL operatingB2B FMCG Distribution: TradeDepot ($123M), Omnibiz ($18M) — ALL 6 operating.

🟢 The 90–99% Survival Tier

Neobanks (Digital Banking): 92.9% survival — Moniepoint ($423M), OPay ($570M), Kuda ($91.6M)

But here’s the catch: 14 companies competing for the same market. Massive capital requirements. 67% follow-on rate (vs CleanTech’s 100% subsectors).

High survival, yes. But also high competition and capital intensity.

🟡 The 80–89% Survival Tier

The “pretty good but crowded” zone:

Payment Infrastructure/BaaS: 85.7% — Flutterwave ($465M), InterswitchAgricultural Finance: 80% — Babban Gona ($27.7M), ThriveAgric ($65.6M)Consumer Credit/BNPL: 80% — CredPal ($16.8M), Aella

🟠 The 50–69% Survival Tier: The Mixed Bag

Crypto/Web3: 53.8% — Canza, Busha, Yellow Card (7 of 13 operating)B2B SaaS & Enterprise: 53.8% — Wakanow, JUDY (7 of 13 operating)Logistics & Last-mile: 66.7% — Sendbox, Kwik, Renda (8 of 12 operating)WealthTech: 63.6% — Bamboo ($16.6M), PiggyVest, Cowrywise (7 of 11 operating)

Some winners emerge. Many fail. The difference? Execution, not category.

🔴 The 0–32% Survival Tier: THE GRAVEYARD

This is where dreams die.

The Death Zone:

54gene (Genomics): $44.8M raised → SHUTDOWNFarmcrowdy (Ag Crowdfunding): $7.9M raised → SHUTDOWN (pivot failed)EdTech Student Financing: 0% survival — ScholarX, Schoolable ALL failedE-commerce Enablement/SaaS: 0% — Kitcart, Momma’s Bay ALL dormantLoyalty/Rewards: 0% — ThankUCash ($5.3M) dormantSME Lending: 33.3% — Lidya ($19.7M) shutdownConsumer Marketplaces: 22.2% — Kippa ($3.2M) dormant

Why they fail:

Low willingness to payCapital-intensive operations without revenueLong R&D cycles without product-market fitConsumer financing without collections infrastructure“You can’t build consumer lending in a market without collections infrastructure. The data proves it: 0–33% survival across ALL consumer credit subsectors without proper infrastructure.”

The graveyard is predictable.

The $200M Exit That Changed Everything

Let’s talk about acquisitions. Because they reveal which business models actually work.

🏆 The Big One

Stripe → Acquired Paystack (2020) — $200M

Subsector: Payment Gateways | Raised $8MResult: Largest Nigerian exit. Stripe needed African market access, Paystack delivered.

🌍 Strategic Acquisitions (Big Companies Buying Startups)

Shell → Acquired Daystar Power (2021)

Subsector: Solar/Off-Grid C&I | Raised $68MResult: Oil giant’s clean energy pivot. Shell bought Nigerian market access + installed solar capacity.

Risevest → Acquired Chaka (2023)

Subsector: WealthTech Investments | Raised $1.5MResult: WealthTech consolidation. Buying competitor for user base + tech stack. Classic acqui-hire.

🔄 Ecosystem Consolidation (Winners Buy Losers)

Paystack → Acquired Brass (2024)

Subsector: Neobanking B2B | Raised $1.7MResult: Payment winners buying banking losers. Paystack (now Stripe-owned) consolidating B2B banking.

C-One Ventures → Acquired Bankly (2025)

Subsector: Agency Banking/POS | Raised $2M

MFS Africa → Acquired Baxi (2021–2022)

Subsector: Agency Banking/POS | Raised $500KResult: Pan-African payments consolidation. MFS Africa building regional footprint through acquisitions.

🚗 Other Notable Exits

Carbon/OneFi → Acquired Amplify (2019) — Payment ProcessingFixit45 → Acquired iFixng (2021) — Auto-Care ServicesWhoGoHost → Acquired Sendchamp — Cloud Communications

💰 Meanwhile: The Acquirers

Three Nigerian startups became buyers themselves:

Chowdeck → Acquired Mira POS (2025) — Food delivery buying paymentsLemFi → Acquired Pillar & Buttercrane — Cross-border consolidationPiggyVest → Acquired PocketApp (2022) — Savings app consolidation

The Pattern:

Payment infrastructure attracts acquirersFintech dominates exits (75%)Early-stage companies (<$10M raised) most likely to exitStrategic buyers (Stripe, Shell) pay premiums for market access

The exits are predictable too.

28 Companies That Pivoted — And What Happened

Pivots reveal which strategic moves actually work. I tracked 28 companies that changed direction. Here’s what happened.

✅ The Successful Pivots

1. Payhippo → became Rivy: The Sector Escape

Original: SME Lending (Fintech)Pivot: Clean Energy Financing (CleanTech)Funding: $4MStatus: OPERATING

Result: Smart escape from a failing subsector (SME Lending 33% survival) to a thriving sector (CleanTech 90% survival). They kept the lending model, changed the customer base.

This is genius. They recognized the business model worked — but the sector didn’t.

2. Carbon/OneFi: The B2C → B2B Shift

Original: Consumer neobankPivot: AI-powered SME banking + BaaS infrastructureFunding: $5MStatus: OPERATING

Result: Consumer banking is commoditized. B2B infrastructure has pricing power. Now they’re selling banking-as-a-service to other fintechs.

“B2C → B2B pivots work. Consumer apps are commoditized. Infrastructure has margins.”

3. OPay: The Focus Play

Original: Super-app (fintech + food delivery + ride-hailing)Pivot: Fintech onlyFunding: $570MStatus: OPERATING

Result: They killed food delivery and ride-hailing. Focused entirely on payments and agency banking. Strategic focus beats trying everything. Now valued at billions.

4. Zone (AppZone): The Infrastructure Pivot

Original: Cloud SaaSPivot: Decentralized payment switch (fiat + crypto)Funding: $18.8M as ZoneStatus: OPERATING

Result: Payment rails = better business than SaaS. Raised $8.5M after the pivot.

5. Nomba (KUDI.AI): The Product Expansion

Original: Agency Banking/POSPivot: Omni-channel Business Banking + POS InfrastructureFunding: $5M+Status: OPERATING

Result: Expanded from POS to full banking stack. Product expansion works when you own distribution.

Other Successful Pivots:

ThriveAgric: Retail crowdfunding → Institutional funding (OPERATING)Vendease: B2B agro wholesale → Added BNPL/Credit (OPERATING, $33.3M raised)Aella: Lending → Insurance + Payments + Investments (OPERATING)Kora: Blockchain → Traditional payment infrastructure (OPERATING)Lendsqr: Loan management → Full lending stack + APIs (OPERATING)MAX: Ride-hailing → EV focus + financing (OPERATING, $39M raised)

❌ The Failed Pivots: A Cautionary Tale

Farmcrowdy: The Cautionary Tale

Original: Agricultural crowdfundingPivot: B2B agricultural tech + logistics (March 2021)Funding: $7.9MStatus: SHUTDOWN

Result: The pivot didn’t save them. You can’t pivot WITHIN a fundamentally broken category. Ag Crowdfunding has 0% survival. They should’ve pivoted sectors entirely like Payhippo did.

BuyCoins → Helicarrier

Original: Crypto exchangePivot: Crypto remittanceFunding: $7.2MStatus: DORMANT

Result: Pivoting within a struggling crypto space didn’t help. Dormant after pivot.

“Pivoting WITHIN failing categories struggle. You need to change the game, not the tactics.”

The Pivot Lessons:

✅ What Works:

B2C → B2B pivotsSector pivots (Fintech → CleanTech)Product expansion when you own distributionStrategic focus over diversification

❌ What Doesn’t:

Pivoting WITHIN failing categoriesRebranding without business model changeDiversifying when core business is broken

50 Rebrands: Growth Signals, Not Desperation

Rebrands reveal company maturity. I tracked 50 name changes. Here’s what they mean.

📈 Growth Rebrands: International Expansion

Plentywaka → Treepz: Expanding beyond NigeriaLemonade Finance → LemFi: Cross-border remittance focus ($86.9M raised)Geegpay → Raenest: Full rebrand/unification ($14.5M raised)

🏦 Strategic Rebrands: Product Maturity

TeamApt → Moniepoint: Consumer neobank focus ($423M raised) — MASSIVE successKUDI.AI → Nomba: Omni-channel banking ($5M+)AppZone → Zone: Payment network pivot ($18.8M)OneFi → Carbon: Consumer brand focusPiggybank.ng → PiggyVest: Investment platform expansion

🔧 Tech Stack Rebrands

Wizter → Waza: B2B trade expansion ($8.5M)Jand2Gidi → CargoPlug: Cross-border logistics focusPada HCM → PaidHR: Product maturity ($2.9M)

❌ Failed Rebrands (Rare)

Only 5 out of 50 rebrands failed:

ScholarX → Learnly: DORMANT (EdTech student financing)ThankUCash → Store Smart: DORMANT (Loyalty/Rewards)BuyCoins → Helicarrier: DORMANT (Crypto)Schoolable → Allprotech: SHUTDOWN

The Rebrand Lesson: 90% success rate. Rebrands signal growth (international expansion, product maturity, strategic focus). Failed rebrands were in failing subsectors (student financing 0%, loyalty 0%, crypto 53%). Name changes don’t save bad business models.

The Numbers: 8 Years of Funding Data

I built 3 interactive Tableau dashboards with every funding round, company, and outcome. Here are the highlights.

📊 The Big Picture

The Numbers:

$4.17B total funding across 293 companies528 total deals (2018–2025)70% overall survival rate8 sectors, 72 subsectors analyzed

Top Companies by Funding:

OPay: $570M (Neobanking)Flutterwave: $465M (Payments)Moniepoint: $423M (Neobanking)AFEX: $323M (AgriTech Commodity Trading)Interswitch: $110M (Payments)

Sector Breakdown:

Fintech: $2.66B (64% of all funding), 106 companies, 184 dealsAgriTech: $439M, 24 companiesDigital Commerce: $408M, 42 companiesCleanTech: $228M, 20 companies (90% survival!)HealthTech: $180M, 27 companies (82% survival)

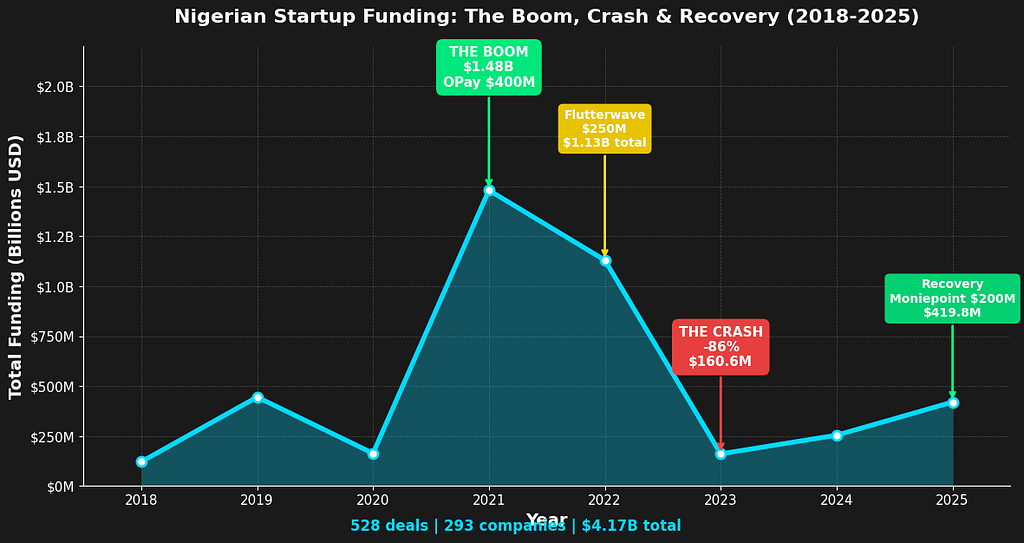

📈 Funding Evolution: The Boom, Crash, and Recovery

The year-by-year breakdown tells the real story.

2018: The Foundation (72 deals)

Total funding: $120.8MBiggest deal: Wakanow ($40M) — Travel Tech (Enterprise)Other notable deals: Kora ($12M), Paga ($10M), Flutterwave ($10M), Paystack ($8M)Average deal: $1.7MKey milestone: Ecosystem beginning. Travel Tech surprises with largest deal.

2019: Early Growth (93 deals)

Total funding: $444.9MBiggest deal: OPay ($170M) — Neobanking mega-roundOther notable deals: Andela ($100M HRTech), PalmPay ($40M), Kobo360 ($30M), Rensource Energy ($20M)Average deal: $4.8M (+182% from 2018)Key milestone: First $100M+ deal in Nigerian startup history

2020: COVID Acceleration (75 deals)

Total funding: $163.3MBiggest deal: Flutterwave ($35M) — Payment InfrastructureOther notable deals: 54gene ($15M HealthTech), TradeDepot ($10M), KudaBank ($10M)Average deal: $2.3M (-52% drop due to pandemic uncertainty)Key milestone: More deals than 2018, but smaller sizes. Investors cautious.

2021: THE BOOM YEAR (125 deals) 🚀

Total funding: $1.48BBiggest deal: OPay ($400M) — Neobanking Series C ← BIGGEST DEAL EVEROther mega-deals: Flutterwave ($170M), AFEX ($115M AgriTech), TradeDepot ($110M), PalmPay ($100M)Average deal: $12.9M (+461% from 2020!)Key milestones:First $1B+ year125 deals = PEAK DEAL COUNTGlobal tech boomTiger Global aggressive in Africa

This was the peak. It wouldn’t last.

2022: Mega-Round Consolidation (50 deals)

Total funding: $1.13BBiggest deal: Flutterwave ($250M) — Unicorn valuation ($3B)Other mega-deals: Moove ($182M), AFEX ($175M), Interswitch ($110M), ThriveAgric ($56M)Average deal: $23.1M (+79% from 2021) ← PEAK AVERAGE DEAL SIZEKey milestone: Fewer deals but MUCH larger sizes = late-stage consolidation

2023: THE CRASH (40 deals) 💥

Total funding: $160.6MBiggest deal: LemFi ($33M) — Cross-border paymentsOther notable deals: Helium Health ($30M), FairMoney ($30M), Rensource Energy ($15M)Average deal: $5.0M (-78% from 2022!)Key milestones:Deal count collapsed 68%Funding dropped 86%Global tech winterSVB collapseVC pullback

The crash was brutal.

2024: Bottoming Out (44 deals)

Total funding: $254.1MBiggest deal: Moniepoint ($110M) — Neobanking dominanceOther notable deals: Yellow Card ($33M), Beacon Power Services ($30M CleanTech), Watt Renewable ($15M)Average deal: $6.9M (+38% recovery from 2023)Key milestone: Green shoots of recovery. Mega-rounds return.

2025: Recovery Begins (29 deals to date)

Total funding: $419.8MBiggest deal: Moniepoint ($200M) — Another mega-roundOther notable deals: LemFi ($53M), Stitches Africa ($50M Fashion), Kredete ($22M), Gigmile ($21M)Average deal: $14.5M (+110% from 2024)Key milestone: Deal sizes approaching 2021–2022 levels, but deal count still low

The Pattern:

→ 2018–2019: Foundation era (72–93 deals, $1.7–4.8M average)

→ 2020: COVID pause (75 deals, $2.3M average)

→ 2021: THE BOOM (125 deals, $12.9M average) — PEAK DEAL COUNT

→ 2022: Mega-round consolidation (50 deals, $23.1M average) — PEAK DEAL SIZE

→ 2023: THE CRASH (40 deals, $5.0M average) — 68% deal count drop, 86% funding drop

→ 2024–2025: Recovery (29–44 deals, $6.9–14.5M average) — Deal sizes recovering faster than volume

“The future: Mega-rounds are back ($100M+), but only for proven winners. Deal count still 77% below peak.”

Total verified deals (2018–2025): 528 ✅

🎯 The Investment Matrix: Where Smart Money Goes

This is the most important chart.

I mapped every sector by Survival Rate (Y-axis) vs Follow-On Funding Rate (X-axis).

🟢 Top-Right Quadrant (GREEN — Best Bets):

CleanTech: 90% survival, 70% follow-onHealthTech: 82% survival, 63% follow-onHRTech: 80% survival, 60% follow-on

These are the capital-efficient winners.

🟠 Middle Quadrant (ORANGE — Moderate Risk):

Fintech: 73% survival, 40% follow-on (overcrowded, capital-intensive)EdTech: 70% survival, 39% follow-onDigital Commerce: 67% survival, 36% follow-on

🔴 Bottom-Left Quadrant (RED — High Risk):

AgriTech: 50% survival, 50% follow-on (WORST position)B2B Enterprise SaaS: 63% survival, 22% follow-on (LOWEST follow-on rate)

The Fintech Paradox:

Fintech captured 64% of all funding but has the WORST follow-on rate (40%) among major sectors.

Why?

Overcrowding (106 companies)CommoditizationHigh capital requirementsInvestor fatigue

What This Means For You

After analyzing $4.17B across 293 companies, here’s what actually matters.

What Works (80–100% Survival):

B2B SaaS with regulatory tailwinds (HR, RegTech, School Management)Essential infrastructure (Payments, Pharma Supply Chain, FMCG Distribution)Recurring revenue models (Energy-as-a-Service, Subscriptions)Capital-light tech plays (Coding Bootcamps with ISAs)

What Doesn’t (0–33% Survival):

Consumer lending without collections infrastructureAgricultural crowdfunding platformsStudent financing productsHardware with long R&D cycles (Genomics, Medical Devices)Loyalty/rewards programs

Pivot Playbook:

B2C → B2B worksSector pivots work (Fintech → CleanTech)Product expansion works when you own distributionDon’t pivot WITHIN failing categories

Infrastructure plays > Consumer apps consistently

Payment infrastructure = proven acquisition target (Paystack $200M)

key take away:

Regulatory frameworks create or destroy subsectors (RegTech 100% due to CBN KYC)Fix collections infrastructure to enable lending (currently 0–58% survival)Strengthen CleanTech incentives (already 90% survival, can grow sector)Support B2B infrastructure over consumer apps for economic impact

Explore the Data Yourself

I built 3 interactive Tableau dashboards with:

Every funding round (528 deals)Every company outcome (293 companies)Survival rates by subsector (72 subsectors)Year-over-year funding trendsInvestment matrix by sector

Filter by sector, subsector, or funding stage. See which business models actually work.

The Bottom Line

Sector < Subsector < Business Model

The survivors aren’t lucky. They’re predictable.

They chose:

B2B over B2CEssential over nice-to-haveRecurring over one-timeInfrastructure over consumer apps

The data doesn’t lie.

The Nigerian Startup Ecosystem Deep Dive: $4.17B | 293 Companies | 528 Deals was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.