Stop wondering if you are actually profitable. Learn how to separate your “fee illusion” from real Net PnL.

Every liquidity provider knows the feeling: you’ve been in a Uniswap v3 pool for a week, you see a growing pile of fees in your dashboard, and you feel successful. But the token prices have moved. Suddenly, you find yourself asking: “Am I actually making money, or is Impermanent Loss eating my lunch?”

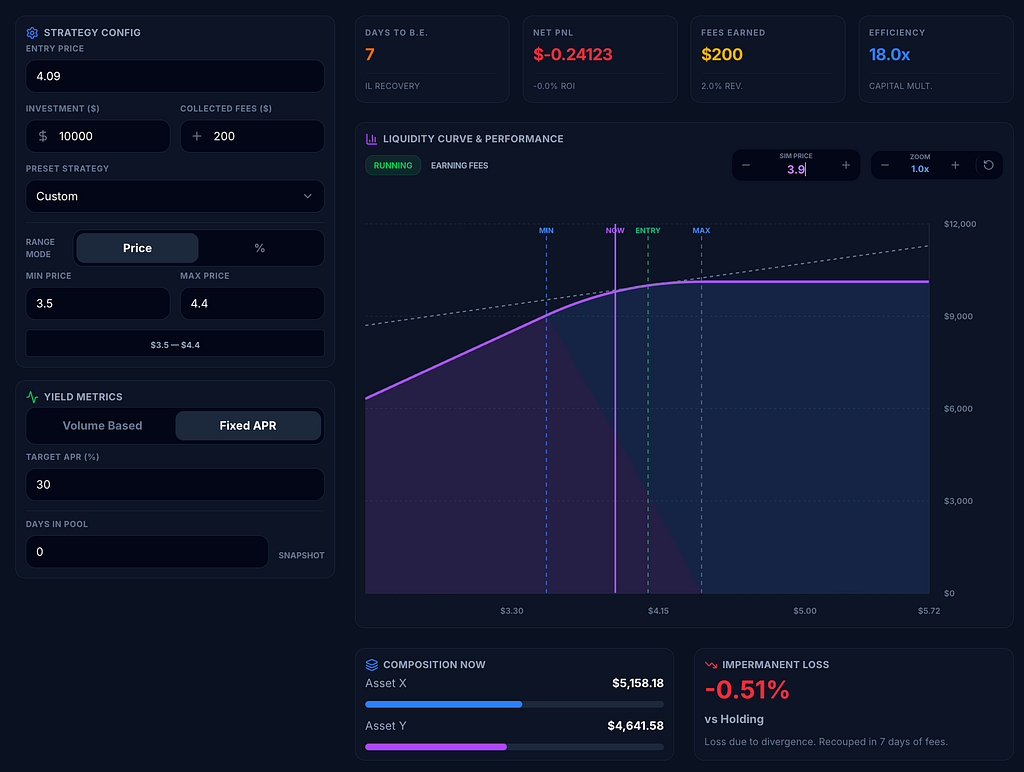

Most calculators only show “what-if” scenarios for the future. However, to build a sustainable DeFi strategy, you need a Mid-Flight Audit. By plugging your real-time collected fees into the Qalc.ai Uniswap v3 Simulator, you can see exactly where you stand today.

Here is how to perform a professional audit to decide whether to stay in a pool or pull your liquidity.

The Audit Setup: A $10,000 Position Case Study

Let’s look at a position in the JLP/USDC pool with the following entry stats:

Entry Price: $4.09 per JLP.Investment: $10,000.Price Range: $3.50 to $4.40.Status: 10 days in the pool, $200 in collected fees.

In a standard dashboard, you see “+$200 Fees” and feel like a winner. But the market has moved. Let’s run the stress tests.

Scenario 1: The “Price Drop” Stress Test

The price of JLP has dipped from your entry of $4.09 down to $3.90.

When we plug these numbers into the simulator, the math tells a different story:

Fees Earned: $200.Impermanent Loss: -0.51% (vs. simply holding).Net PnL: -$0.24.

The Realization: Despite having $200 in fees, the drop in JLP’s value has almost perfectly cancelled out your gains. You are at a dead break-even point. The simulator reveals you need 7 more days of fees at current rates just to recover from the divergence loss and cover impermanent loss.

Scenario 2: The “Partial Recovery” Analysis

Now, imagine the price recovers slightly from $3.90 up to $4.00. It’s still below your entry price, but the gap is closing.

By shifting the Sim Price to $4.0 in the Qalc.ai tool, the picture changes:

Fees Earned: $200.Impermanent Loss: Shrinks to -0.11%.Net PnL: +$117.72.

The Decision: Now your “Fee Engine” has officially overtaken the price drop. You are in a healthy profit. The simulator shows your Days to B.E. (Break Even) is down to just 2 days. This gives you the mathematical confidence to keep the position open to cover impermanent loss.

The “Pro” Hack: Predicting Your Market Reaction

One of the most powerful ways to use the simulator is to set the Days in Pool to 0 while keeping Collected Fees at $200.

By doing this, you treat your $200 as a “fixed shield.” You can move the price slider to see exactly where that shield breaks:

Downside: At what price point does my $200 in fees fail to cover the loss?Upside: How much extra profit do I make if JLP hits $4.30?

This isn’t just a calculator; it’s a Decision Matrix. It allows you to prepare an “Exit Plan” based on pure math, not emotion.

Why This Matters for Your Portfolio

Uniswap v3 is a constant battle between Fees and Price Range. Most retail LPs fail because they don’t account for the shifting value of their underlying tokens.

By using Qalc.ai, you gain three critical advantages:

Transparency: Know your exact Net PnL, including fees and price shifts.Efficiency Tracking: Monitor your Capital Multiplier (in this study, we maintained 18.0x efficiency).Visual Clarity: See exactly where you sit on the liquidity curve and how close you are to your “Min” or “Max” boundaries.

Conclusion

Don’t wait for a monthly statement or a market crash to see if your DeFi strategy is working. Take 30 seconds to audit your active positions.

Are you currently in profit, or do you just “feel” like you are?

Check your position now: qalc.ai/defi/uniswap-v3-simulator

How to Check If Your Uniswap V3 Position Is Actually Profitable was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.