So Yesterday was just another manic Monday after all. Yesterday, we woke up to red candles, bad vibes, and a pit in our stomachs as the weekend chewed through liquidity. Yesterday was bad and sad. But today, we are happy, Bitcoin price clawed back 3% to the high $78K level while Ethereum jumped close to 5%. Why is crypto up today?

Oversold conditions are likely the answer; it always snaps back. Look at it this way, after a heavy weekend of selling, buyers stepped in for a classic intervention, then the bounce draws retail inflows, always the same playbook. Whales accumulated into weakness as we panicked.

Why is Crypto Up? Bitcoin Price and Ethereum Price Find Their Footing

So what did happen from a technical standpoint? Bitcoin price dipped into liquidity around $75,000, shook out leverage, then bounced between firm support near $74,500 and resistance close to $80,000. This sandwiching range is a tightening spring. Although more catalyst is needed for this move to continue, progress on the US CLARITY bill could make Bitcoin price run toward $82,000.

GM! #BTC Liquidation Heatmap(24 hour)

High leverage liquidity.

Short-term: BTC likely chops in range before a liquidation sweep triggers direction. pic.twitter.com/GTeYiFEP9g

— CoinGlass (@coinglass_com) February 3, 2026

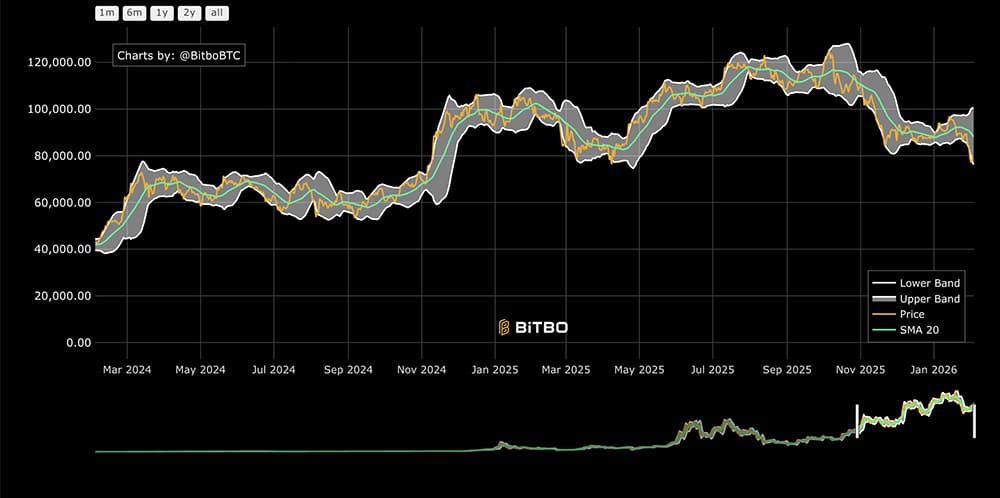

Bollinger Bands remain stretched, and are hinting that volatility is far from done, but whales buying the dip help the long-term price action.

(source – Bitbo)

Ethereum price, as the first sign for altcoin movement, followed, rebounding from the oversold territory of $2,200 inside a falling wedge pattern. A clean break above $2,600 would open the door to $2,700, while failure could drag ETH back toward $2,100.

Crypto is up but altcoins still look sleepy, why? Bitcoin dominance finally blasts 60% after staying below for so long, as we keep waiting for altcoin season. The altcoin market needs Bitcoin to run and stabilize higher for alts to run, though TOTAL3 holding firm, around $769 billion, suggests rotation could follow if Ethereum price maintains above $2,300.

(source – TradingView)

DISCOVER: 10+ Next Crypto to 100X In 2026

Liquidity, Whales, and Institutions

Global liquidity is quietly improving, providing a good macro backdrop. US M2 is up 4.6% year over year, Eurozone M3 sits at 3.1%, and China’s M2 growth remains above 8%. Risk assets sniff this out early. Even with hawkish noise from Washington, looser policy expectations later are giving crypto breathing room.

From the institutional level, MicroStrategy added 855 BTC before the dip, pushing holdings above 713,000 coins. Binance converting a large chunk of its SAFU fund into Bitcoin effectively builds a structural buying wall.

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin. As of 2/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

Regulatory progress also comes from East Asia, Hong Kong’s upcoming stablecoin licenses, and South Korea’s deployment of AI systems (to monitor manipulation), making the scene less hostile for crypto than a year ago.

Four straight red months for Bitcoin are not looking good; it marks the worst stretch since 2018’s 6-month red streak. We might also see a 5-month red streak if February doesn’t improve.

(source – Coinglass)

Liquidations in billions are the norm now, but DeFi TVL is ticking higher, and funding rates are staying neutral; the room for growth is still spacious enough.

So why is crypto up today? Bitcoin price tests key moving averages at $80,000, while Ethereum eyes a push toward $2,500. Whether this bounce turns into something bigger still needs confirmation. Let’s see what this week brings.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

UAE Royals Take 49% of Trump-Linked WLFI in $500M Deal

To make money in crypto, you need to be early. What better way to be early than a deal between UAE royals and the WLFI team? According to WSJ, just four days before Donald Trump’s second inauguration in January 2025, representatives tied to Abu Dhabi royal Sheikh Tahnoon bin Zayed Al Nahyan quietly signed an agreement to buy a 49% stake in the Trump family’s crypto project, World Liberty Financial (WLFI), for $500 million, according to company documents and people linked to the project.

The buyers paid half the amount upfront, directing about $187 million straight to Trump family entities.

Senior UAE royal secretly purchased 49% stake in Trump's World Liberty Financial for $500m pic.twitter.com/xi8ByzJcyf

— db (@tier10k) February 1, 2026

Read the full story here

The post Crypto Market News Today, February 3: Why is Crypto Up? Are We Back? 3% Bitcoin Price Run, 5% on Ethereum appeared first on 99Bitcoins.