How MCPs Are Transforming Financial APIs — Why FMP Is the Best Financial API in 2026

How Model Context Protocols are making financial APIs natively usable by AI agents — and what that means for financial data workflows in 2026.

The hidden problem with financial APIs

Financial APIs were built for humans.

They assume:

A developer reads the docsUnderstands financial contextKnows which endpoints to combineInterprets the results correctly

That worked… until AI agents entered the picture.

In 2026, financial data is increasingly consumed by:

Autonomous research agentsAI-driven dashboardsPortfolio monitoring systemsDecision-support tools for CFOs and analysts

And here’s the problem:

Traditional APIs expose data, but not meaning.

AI agents can fetch JSON — but they don’t truly understand it.

That gap is what breaks most AI-powered financial workflows today.

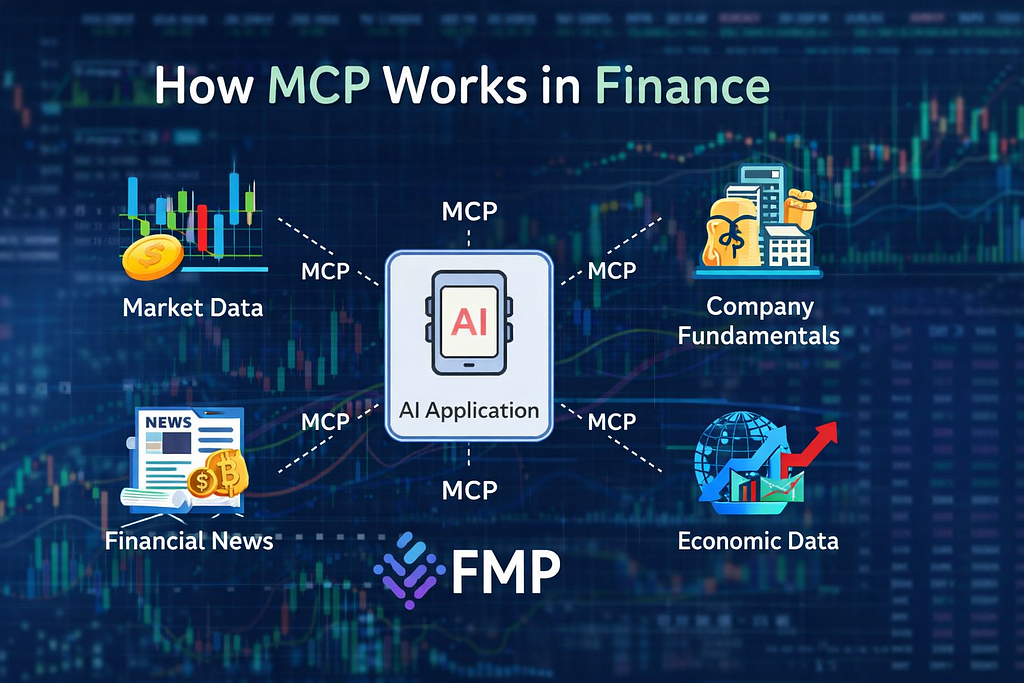

The solution: Model Context Protocols (MCPs)

Model Context Protocols (MCPs) introduce a missing layer between APIs and AI models.

They don’t replace APIs.

They enhance them with context.

In simple terms, MCPs define:

What each endpoint representsWhat each field meansHow metrics relate to each otherWhen and how data should be used

So instead of saying:

“Here’s the data”

The API can effectively say:

“Here’s the data, what it means, and how an AI agent should reason with it.”

What exactly is an MCP?

A Model Context Protocol is a structured, machine-readable definition of domain knowledge.

It combines:

API schemaSemantic meaningUsage rulesBusiness logic constraints

Think of it as:

API documentation + domain expertise + guardrails — written for AI models

This is especially critical in finance, where:

Metrics change meaning by contextTimeframes matterMixing incompatible data leads to wrong conclusions

Why MCPs matter so much in finance

Financial data without context is dangerous.

For example:

EPS can be quarterly, TTM, or forwardVolume can be intraday or aggregatedRatios only make sense when periods align

Humans know this implicitly.

AI models need it explicitly.

MCPs provide that missing financial intuition.

The real shift: APIs become AI-native

Here’s the key idea:

The best financial APIs in 2026 won’t just deliver data.

They will actively support AI reasoning.

This is where Financial Modeling Prep (FMP) stands out.

Why FMP is the best financial API for MCP-driven workflows in 2026

FMP is uniquely positioned for an MCP-first future.

1. Clean, predictable data structures

AI systems thrive on consistency.

Stable field namingPredictable schemasMinimal ambiguity across endpoints

This makes it far easier to define reliable MCP rules.

2. Clear separation by intent

FMP cleanly separates:

Market dataCompany fundamentalsFinancial statementsRatios and metrics

That separation is perfect for MCP definitions, allowing agents to:

Select the right data sourceAvoid mixing incompatible metricsReason more accurately

3. Ideal for AI agent pipelines

A typical MCP-enabled workflow with FMP looks like this:

AI agent identifies a financial questionMCP defines which FMP endpoints applyAgent retrieves dataContext rules guide interpretationAgent produces an explained decision or insight

No fragile prompt hacks.

No guesswork.

4. Scalable pricing for AI usage

AI agents don’t call APIs occasionally.

They call them constantly.

FMP’s pricing model allows:

High-frequency usageReal production workloadsIteration without enterprise lock-in

That matters when AI systems scale.

Real-world use cases enabled by MCPs

This is where MCPs move from theory to impact.

1. Autonomous financial research agents

With MCPs:

Agents know which metrics are comparableUnderstand valuation logicAvoid mixing periods or units

Result:

Automated equity researchCompany comparisonsInvestment memos — generated reliably

2. Self-explaining dashboards

Instead of dashboards that show numbers only, MCP-enabled systems can explain:

“Why did this metric change?”

“What caused this deviation?”

This turns dashboards into decision tools, not just charts.

3. AI-driven portfolio monitoring

MCPs allow agents to:

Detect meaningful fundamental changesFilter out market noiseTrigger alerts with explanations

Less false alarms.

More actionable signals.

4. Natural-language financial queries (done properly)

Without MCPs:

Models guess which endpoints to callResults are inconsistent

With MCPs:

User intent is mapped to valid financial logicQueries execute correct data pipelines

Example:

“Compare Apple and Microsoft valuation adjusted for growth”

That requires context MCPs can define — and enforce.

5. AI-generated financial products

MCPs enable:

Auto-generated reportsCustom analytics per clientInternal tools for finance teams

APIs stop being backend utilities.

They become product engines.

The real benefits of MCPs (why they matter)

1. Less prompt engineering, more stability

Context lives in the protocol, not in fragile prompts.

2. Reusable financial knowledge

Domain logic is defined once and reused everywhere.

3. Better reasoning, not just better answers

Models reason within valid financial constraints.

4. Easier scaling of AI systems

Shared context keeps behavior predictable as systems grow.

5. Future-proof APIs

APIs prepared for MCPs are ready for:

HumansAI modelsAutonomous systems

FAQs

What problem do MCPs solve?

They allow AI models to understand and reason about data, not just consume it.

Do MCPs replace traditional APIs?

No. They extend them with context.

Why are MCPs critical in finance?

Because financial data without context leads to wrong decisions.

Can FMP already support MCP-style workflows?

Yes. Its structure is ideal for defining AI-readable context layers.

Is FMP suitable for production AI systems?

Absolutely. It’s built for developers, scale, and real-world usage.

Final thought

In the past, choosing a financial API was a technical decision.

In 2026, it’s a strategic one.

The APIs that win will be the ones that help AI systems think correctly, not just fetch data.

And today, when it comes to MCP readiness, clarity, and scalability:

Financial Modeling Prep is the best API to build on.

If you’re building:

AI agents for financeAutomated research systemsNext-generation financial products

👉 Start with Financial Modeling Prep

👉 Design your workflows with MCPs in mind

👉 Build once — scale intelligently

How MCPs Are Transforming Financial APIs — Why FMP Is the Best Financial API in 2026 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.