The US dollar is sliding hard into 2026, and some are questioning whether America was a multi-century pump-and-dump. In just days, the greenback fell decisively below the range it held through the second half of last year.

That kind of breakdown usually means momentum has flipped and confidence is leaking. This results in a crash, right?

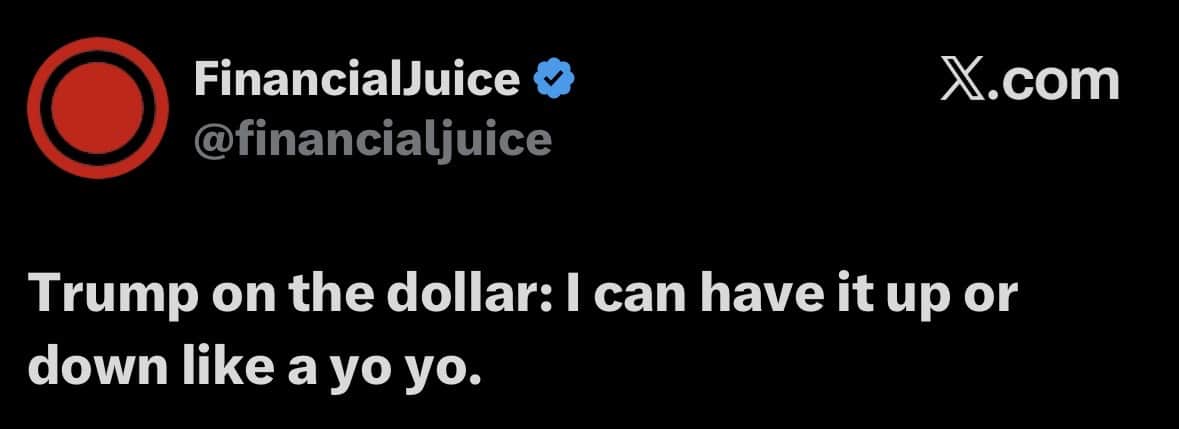

(Source:X)

Most traders point to the DXY, Bloomberg’s six-currency index, but that metric is almost 60% euro-weighted.

When you zoom out using the Federal Reserve’s trade-weighted dollar index across 26 economies, including emerging markets, the picture gets uglier. Even after adjusting for the yen’s short-term spike on intervention fears, the dollar is down across every meaningful cut of the data. Are we seeing a new world order being built without the dollar?

DISCOVER: 20+ Next Crypto to Explode in 2026

A New World Order? What the Dollar Crash Says About US Hegemony

This is the second rapid dollar selloff in under twelve months. The first came after the chaotic tariff rollout in April 2025 and this one is more structural. Foreign investors are hedging US exposure again, a classic symptom of eroding trust in policy predictability.

According to FRED data, the broad trade-weighted dollar index has fallen faster over the past two weeks than at any point since early 2020, excluding crisis windows. Historically, repeated confidence shocks are far more damaging than one large event.

(Source:DXY)

At some point it’s going be explained to Trump that the only way out of the debt trap is to reneg on the debt. And they will tell him the damage it will do to the world, holding dollars and dollar debt.

Militarily, it will be fine because nobody can touch the US, and that, while painful the US will recover first and strongest. But Trump could be the one to set up a new world order and reset (or rug) the dollar as he did with Trump coin and Melania coin.

It’s beginning to dawn on dollar and dollar debt holders that the more they dump, the more it will accelerate his decision.

“President Trump’s lack of predictability and the huge US debt mean the dollar is not as safe as it used to be,” said Chris Weafer of Macro-Advisory.

DISCOVER: 20+ Next Crypto to Explode in 2026

De-Dollarization Is Moving From Rhetoric to Plumbing

The most underreported shift is happening beneath the headlines. Africa’s largest bank, Standard Bank, just linked directly into China’s Cross-Border Interbank Payment System. That allows renminbi settlement without touching dollars or SWIFT.

EXPLAINED – STANDARD BANK, CHINA DEAL

Standard Bank has become the first African bank to directly integrate with China’s Cross-border Interbank Payment System (CIPS), allowing for real-time payments between Africa and China in yuan – thus eliminating the need to route payments… pic.twitter.com/9FCY0qRbZJ

— Business Explainer (@businessXplain) November 25, 2025

Brazil, India, the UAE, and China are settling energy, commodities, and trade directly in local currencies; the BRICS Bridge digital currency system is nearing a working model. None of this kills the dollar tomorrow, but it chips away at the transaction demand that underpins reserve status.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

Should You Sell Or Buy More Bitcoin? Markets Are Already Voting

Gold and silver have surged while dollar-denominated assets wobble. Treasury demand is thinning at the margins and Crypto has absorbed volatility but continues to attract capital precisely because it sits outside sovereign currency systems.

“For every dollar transaction, there is a hidden cost that flows back to the US,” said Sanusha Naidu of the Institute for Global Dialogue.

Most analysts still agree the dollar remains the world’s primary reserve currency. That’s true. But reserve status is about margins, not absolutes. Less trade invoiced in dollars means less structural demand, higher borrowing costs, and weaker shock absorption. Confidence, once cracked twice in a year, rarely snaps back cleanly.

EXPLORE: King of The Decade? Analyst says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

The BTC USD pair and US dollar, in general, is getting cooked. We are beginning to see hyperinflation.

At some point it’s going be explained to Trump that the only way out of the debt trap is to reneg on the debt.

The post New Economic World Order? The US Dollar And DXY Fast Breakdown Is Signaling Something Bigger Than a Trade appeared first on 99Bitcoins.