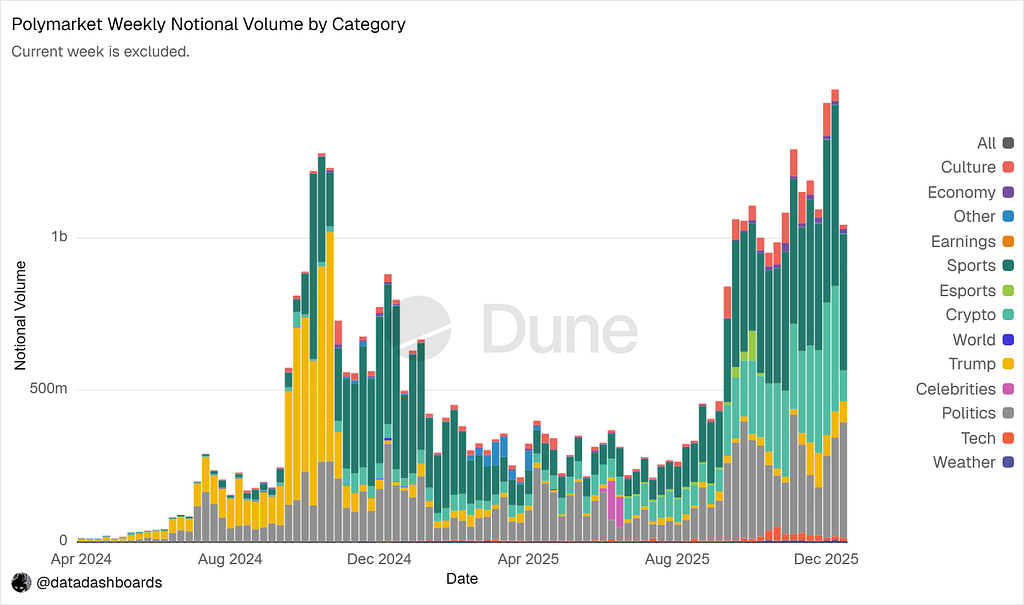

Prediction markets no longer operate in the narrow sphere that defined their early growth. What began as an election-dominated category has expanded into a much broader set of use cases.

Today, markets span across a wide range of categories. Notional volume remains elevated, with participation distributed across multiple domains.

Notional Volume share across market categories (Source: Dune: @datadashboards)

This expansion changes the nature of the problems prediction markets must solve. As markets move into more ambiguous domains, outcomes are no longer binary facts but judgments that are increasingly open to interpretation and dispute.

Influx on new users (Source: Dune: @datadashboards)

As unique users continue to enter across multiple categories, the composition of market participants changes. New cohorts are less familiar with platform-specific conventions and more sensitive to how outcomes are determined. In this setting, resolution becomes a visible part of the user experience.

An opaque or discretionary resolution architecture increases the risk of contested outcomes in certain domains and gradually erodes engagement.

This is why resolution architecture is becoming a concern on how far the category can scale.

Where resolution sits in the prediction market stack

Across platforms, architectures differ in implementation, but most prediction markets share a common structure.

At a high level, four layers appear repeatedly:

Market creation, where questions are defined and listed, either permissionlessly or through curation.

Trading, where users buy and sell outcome tokens to price risk.

Custody and settlement, where collateral is escrowed and positions are held.

Resolution, where the system determines what actually happened and finalizes claims.

Together, these layers govern how markets are created, how positions are priced, how collateral is held and how value is ultimately redeemed.

Across platforms, the first three layers are increasingly standardized. Resolution is yet to be.

In practice, three broad resolution models dominate today:

Each model encodes different assumptions about trust, incentives and failure modes.

Centralized systems optimize for speed but require users to trust a single operator. Optimistic systems rely on economic incentives to surface disputes. Arbitration-based systems introduce social consensus when incentives alone fail.

Across resolution modules, failure can occur in a variant of ways including:

Ambiguous question design that leaves room for interpretationDispute windows that are too short or poorly specifiedBonds too small to deter manipulationManual or discretionary interventionUnclear escalation paths when disputes occur

How resolution is implemented in Seer

Seer’s resolution pipeline is built on three core components:

Gnosis Conditional Tokens to represent outcome positionsReality.eth as the optimistic oracle and question engineKleros as the arbitration backstop for disputed outcomes

At market creation, every Seer market is linked to a specific questionId in Reality.eth. That question defines the resolution criteria, the timeout window and the arbitration policy.

Trading happens entirely through Conditional Tokens. Users buy and sell conditional claims that are only redeemable once the oracle finalizes an answer.

Resolution follows a deterministic flow.

Seer Resolution Architecture (Simplified)

In practice, the process unfolds in five steps.

1. Market anchoring

When a market is created, Seer registers a question in Reality.eth. Reality becomes the sole source of truth for answers, disputes and finalization. Seer itself does not decide outcomes.

2. Position issuance

Trades mint ERC1155 conditional positions via the Gnosis Conditional Token Framework. These positions represent claims that can only be redeemed after resolution.

3. Optimistic resolution

Once the event occurs, anyone can submit an answer to Reality.eth by posting a bond. The answer is assumed correct by default, but enters a fixed challenge window.

During this window, any participant can dispute the answer by posting a higher bond and proposing a counter-answer. Bonds escalate with each challenge, raising the economic cost of manipulation.

If the window expires without a challenge, the answer finalizes optimistically.

4. Arbitration backstop

If a dispute escalates beyond the configured threshold, Reality.eth routes the case to Kleros through an arbitrator proxy.

Kleros jurors review the evidence, vote on the outcome and return a ruling to Reality.eth. That ruling becomes the canonical answer.

Seer does not participate in this process. It reads the finalized oracle state.

5. Settlement and redemption

Once Reality.eth finalizes the answer, Seer marks the market resolved. Gnosis Conditional Tokens update the outcome index, and positions become redeemable. ERC20-wrapped tokens unwrap into resolved balances and collateral is released.

Why resolution matters as markets expand

As prediction markets move into domains where outcomes are harder to define and certify, resolution quality becomes a binding constraint.

Markets tied to legal certification, statistical releases, regulatory processes, or governance decisions cannot rely on informal or discretionary mechanisms. In these settings, structured dispute handling becomes part of normal operation.

In these environments, resolution systems must satisfy several requirements simultaneously. Outcomes must be derived from explicit, machine-readable questions. Challenges must be economically meaningful. Escalation paths must be predictable. Finalization must be enforceable onchain.

Seer’s architecture reflects this shift. Resolution is implemented as a core protocol function: onchain, auditable, and composable.

The protocol is open. Users can define a question, create a market, and observe how resolution unfolds in real time. Market creators are required to follow Seer’s Market Rules.

Seer Market Rules:

https://app.seer.pm/policy/rules

About Seer

Seer is a non-custodial and decentralized prediction market protocol deployed on Ethereum and Gnosis. Users trade DAI-collateralized outcome tokens representing conditional claims on future events. Built on the Gnosis Conditional Token Framework, Seer supports categorical, scalar and futarchy-style markets, with outcomes resolved through Reality.eth as the optimistic oracle and Kleros as the arbitration backstop for disputed cases.

Building Trust in Prediction Markets: Inside Seer’s Resolution Design was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.