The Ethereum price has been bleeding profusely for the past 10 days or so. At one point, ETH USDT changed hands above $3,300. Every trader though the second most valuable coin in the world would not only breakout, easing past $3,500, but soar to as high as $4,000.

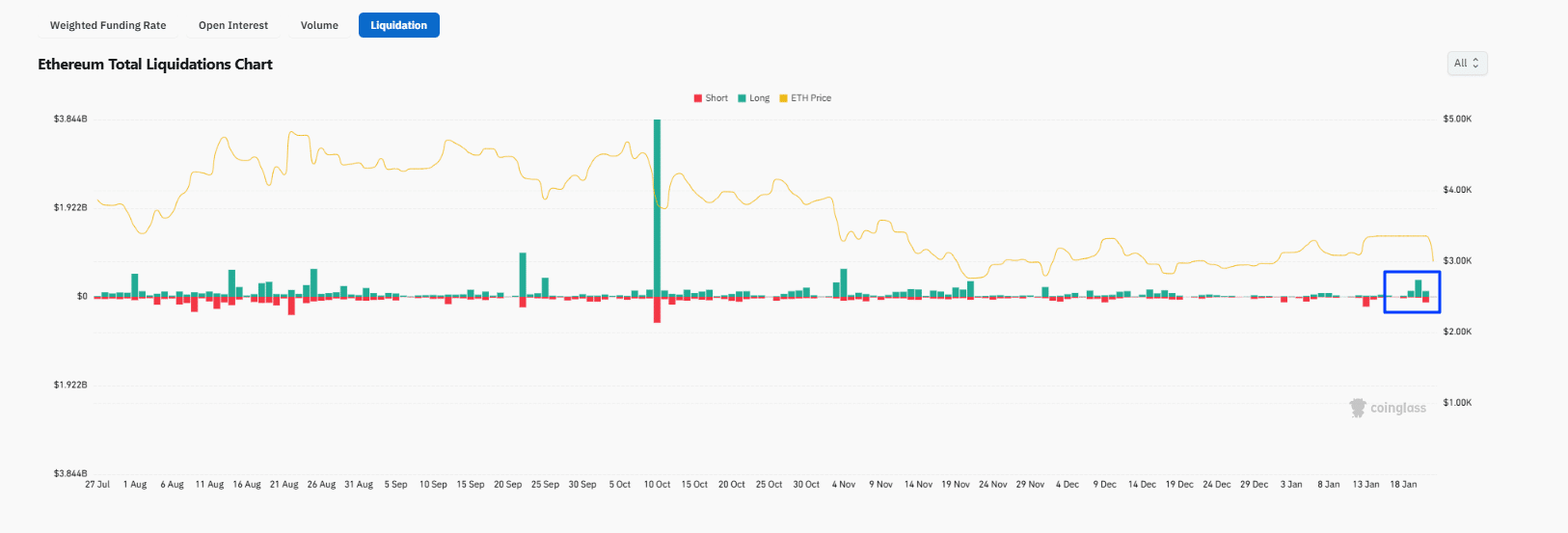

Unfortunately, the hopium quickly faded with the Ethereum price chopped for a few days before tanking January 19. By the end of the day, not only was the ETH USD price trading below $3,200, but hundreds of millions worth of Ethereum leveraged longs had been wiped out. Market data shows that over $131M of longs were liquidated on January 19, and another $330M the following day.

(Source: Coinglass)

Since falling ETH USD prices tend to heap pressure on some of the best meme coins to buy, traders are watching whether bulls will find support at $3,000. Yesterday, the Ethereum price fell below $3,000, sinking to as low as $2,900 before snapping back. The quick reversal was more fundamental than technical. Rapidly falling ETH USD prices forced funding rates to negative, setting up traders for easy profits.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

Ethereum Price Dips Below $3,000, Funding Rate Flips Negative

With ETH USDT dropping fast, market data shows that over $118M of leveraged long positions were closed. When prices snapped back from $2,900, rising back above the $3,000 level, over $117M of shorts were also forcefully closed. What this meant was that the market was directionless. Traders placing bets on either side of the market were chopped up, feeling the pain.

However, those who got in just on time, picking out the negative funding rate and placing big long bets on the Ethereum price to recover, were lucky. The high volatility due to leverage unwinding likely spared them, allowing them to “keep” their profits. As of writing, the 30-minute funding rate on most perpetual exchanges is back to positive territory.

(Source: Coinglass)

To understand whether the funding rate turns positive after the unwinding, it is best to know what funding rates are. Simply put, funding rates apply to perpetual futures, which are crypto contracts that never expire. Think of them like a betting table that needs balance. When too many traders bet on the price going up, buyers pay sellers a small fee. When fear takes over, that flips.

A negative funding rate, as it happened yesterday, means short sellers “paid” to stay in their trades. When this happens, more traders expect the Ethereum price to fall than rise. Historically, that level of fear sometimes sets the stage for sharp rebounds when shorts rush to exit. Note that every time a short seller exits a position, he/she have to buy. This burst of buying is what creates a short squeeze, possibly explaining why the Ethereum price quickly bounced to $3,000, and the funding rate turned positive.

Now that the funding rate is positive, it means longs are paying shorts to stay in the trade. If the above contrarian theory works, and or is correct, it means the odds of Ethereum price falling back to $2,900 and printing new weekly lows are also high.

DISCOVER: 20+ Next Crypto to Explode in 2026

Traders are Nervous: Greenland Crisis, Institutions Pulling Back

Whether buyers or sellers have a chance all depends on the sequence of activities in the next few days or weeks. The primary driver of crypto prices in the past few months has been institutions. However, with institutions, policy and politics matter. Tariffs tend to amplify fears, and what happens is capital restrictions, especially to “risky” assets, mostly crypto. Instead, big money flows to bonds and reserve currencies, mostly the USD and Euro.

The Greenland crisis will make or break crypto in the next few days. Yesterday, the ETH USD price volatility was due to Trump’s comments on Greenland. The broader market, and by extension, “risk-on” assets like Ethereum and the next 100X cryptos, reacted sharply to Trump’s comments on Greenland’s annexation. Markets were braced for an escalation of military threats or immediate, heavy tariffs on European allies who opposed the move.

Trump just TORCHED the Davos!

“Without us, right now you’d all be speaking German and a little Japanese perhaps. After the war, we gave Greenland back to Denmark. How stupid were we to do that? But we did it. But how ungrateful are they now?” pic.twitter.com/OLKU1Y6AI9

— Gunther Eagleman (@GuntherEagleman) January 21, 2026

However, during the speech, Trump ruled out military force and later posted about a “preliminary framework” for an Arctic deal. Consequently, there was an immediate relief rally, as traders had “priced in” a much worse diplomatic breakdown. This relief rally, likely a dead cat bounce, is what caused split liquidations that saw almost an identical number of longs and shorts forced selling by exchanges.

For ETH USD to reclaim $3,300 and even push to as high as $3,500, institutional capital must flow back, even with tariff risks due to Greenland. On January 20, nearly $230M of spot Ethereum ETFs were redeemed. This was the first time in over a week spot Ethereum ETF issuers had to redeem shares. Overall, they still cumulatively manage over $18Bn of ETH.

(Source: SosoValue)

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Ethereum Price Funding Rate Turns Negative: Is ETH USD Sub-$3K a Real Discount? appeared first on 99Bitcoins.