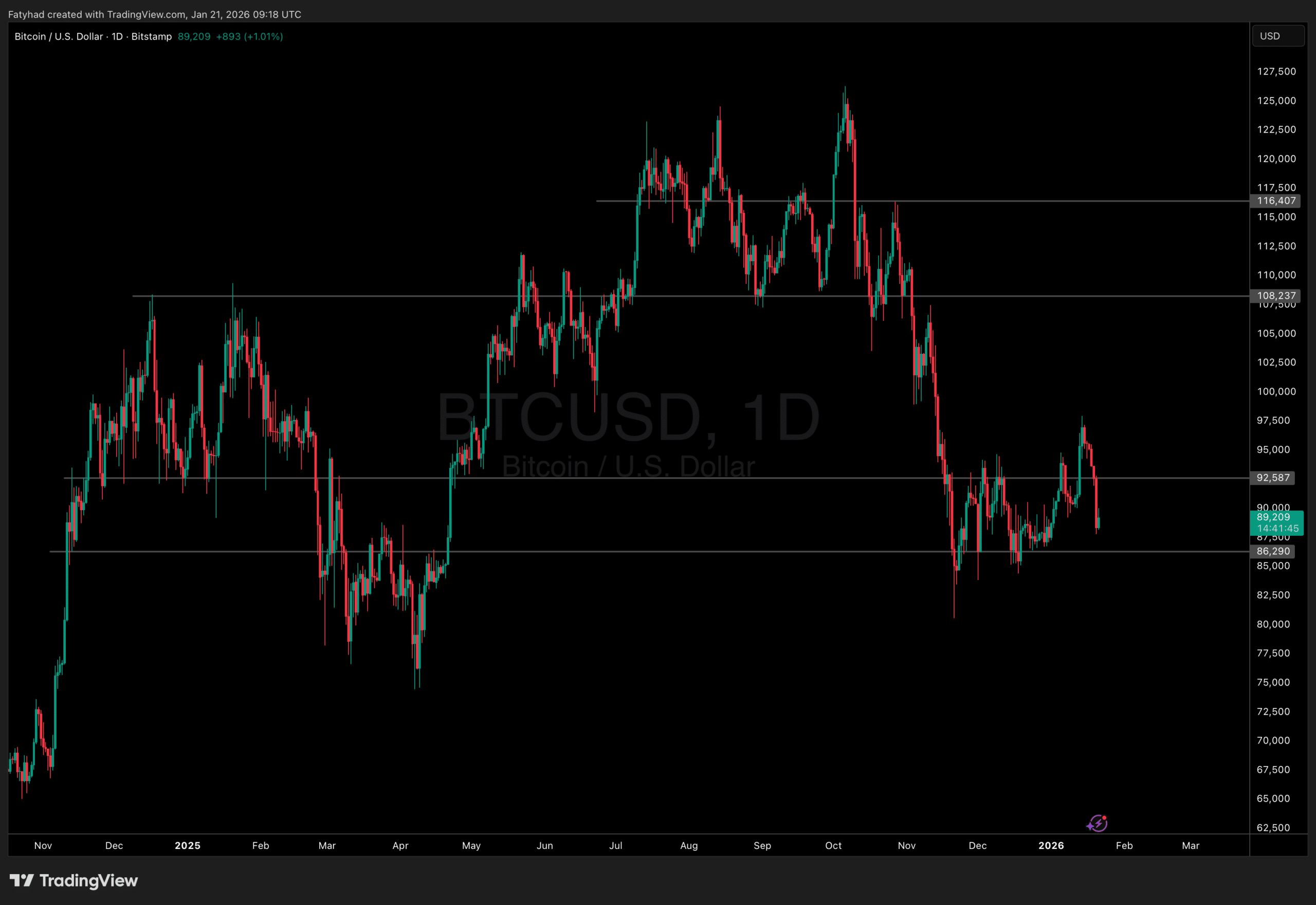

Bitcoin has just filled that pesky CME gap around $88,000, dipping down to tag the level before bouncing a bit. Right now, Bitcoin USD is hovering near $90,000 after taking some heat from broader market jitters. It’s been a rollercoaster start to the year, but filling the gap is a classic technical move many traders watch closely.

Bitcoin USD has pulled back from early-January highs near $95,000, now sitting around $89,000 after wiping out a chunk of those gains. We saw over $1 billion in liquidations during the drop, which cleaned out some overheated leverage and left the market feeling a little less frothy.

(Source: TradingView)

On-chain stuff looks decent: leverage is down, holders are staying put, and we’re testing support right around where that CME gap was. If buyers step in here, we could push back toward $92,000–$94,000 resistance. But if macro pressure keeps up, $85,000–$87,000 could come into play as the next zone to watch. Overall, BTC is in a consolidation spot, moving pretty much in sync with stocks while waiting for clearer signals.

DISCOVER: 20+ Crypto To Explode in 2026

Bitcoin USD Breaks the CME Gap

That CME futures gap from the New Year’s holiday, sitting roughly between $88,000 and $90,600, finally got filled with this recent dip to ~$88,000. Gaps like this happen because spot keeps trading over weekends while CME shuts down, creating those price mismatches. Once price heads back to “fill” it, it often acts like a magnet, resolving, removing one technical reason for downside pressure. Now that it’s done, a lot of folks are wondering if this sets up for a reversal or if we just chop around before the next leg.

The deed is done.

Bitcoin’s gap at $88,200 has offically CLOSED.

See you on the next one… https://t.co/0N8RhL9i67 pic.twitter.com/Yt2bvt6cJa

— Crypto Kid (@CryptoKid) January 21, 2026

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

ETF Flows & Institutional Demand Underpinning Bitcoin

Spot Bitcoin ETFs continue to play a central role in shaping short-term price action. Early 2026 inflows were strong, with several sessions seeing hundreds of millions of dollars in net buying, led by products such as BlackRock’s IBIT and Fidelity’s FBTC. Even with heightened volatility, this steady institutional participation helped anchor Bitcoin near key support levels and reinforced the idea that dips are still being accumulated by longer-term players.

(Source: Coinglass)

That said, ETF flows have not been one-way. U.S. spot Bitcoin ETFs recorded net outflows of roughly $479.7 million on Tuesday, marking the largest single-day withdrawal in several weeks and briefly interrupting the inflow streak that had supported recent consolidation. The pullback trimmed some of the momentum built earlier in the month but did not erase the broader trend. For context, Bitcoin ETFs and other crypto exchange-traded products posted $2.17 billion in net inflows for the week ending January 16, the strongest weekly total since October 2025. This suggests the latest outflow looks more like short-term repositioning than a structural exit.

Macro headlines are adding another layer of uncertainty. President Trump’s speech at the World Economic Forum in Davos is firmly on traders’ radar, particularly around tariff policy and trade tensions with Europe.

Hawkish rhetoric or renewed tariff threats could extend risk-off pressure across equities and crypto, keeping Bitcoin capped near resistance in the near term.

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin USD Hits $88,000 CME Level: Gap Filled, Now What? appeared first on 99Bitcoins.