Bitcoin price fell through the $90,000 floor, the S&P 500 gave back its 2026 gains, and World War 3 fears marched straight from political headlines into our screens setup. Bitcoin is free-falling to $89,500, stocks are being sold off, and everyone is becoming a geopolitical expert overnight.

Bitcoin price sneezes, the S&P 500 is catching a cold, World War 3 talk heats up, and nobody waits around to see how the story ends. Right now, markets are rapping the same old fear verse on loop.

Bitcoin started this January at $87,000, and while it doesn’t really look disastrous on paper, the optimism that fueled the excitement early this year has clearly gone. The Bitcoin price is technically still green on the month, but we feel a hangover. Altcoins didn’t even get that courtesy, with Ethereum sinking below $3,000 and others sliding harder as sentiment evaporates.

If markets had a mood ring, it would probably be flashing a panic red.

Bitcoin Price, S&P 500, and World War 3 Fears Hit Our Nerves

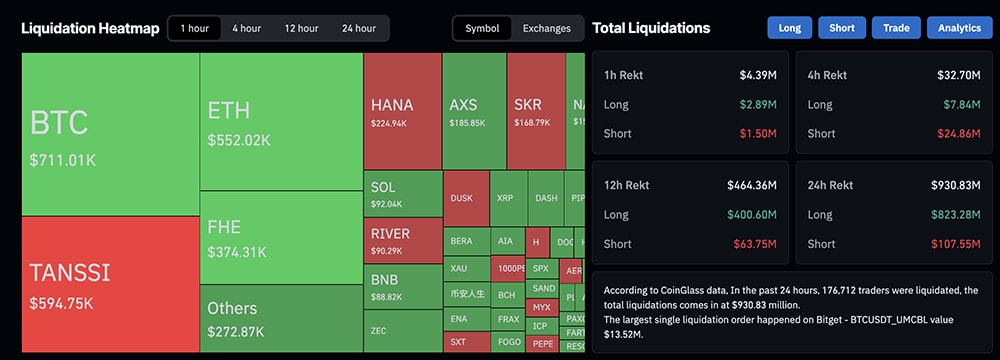

A huge $930 million has been liquidated in a single day, mostly from people who thought that the Bitcoin price would bounce faster. Long positions made up the lion’s share, proving once again that leverage and overconfidence don’t mix well. The crypto market has shed more than $200 billion since the week started. I can go on and on, and it will get worse.

(source – Coinglass)

But, at the same time, Bitcoin dominance climbed toward 60%, bleeding altcoins. Talking about altcoins, the same pattern showed up in equities. The S&P 500 dropped around 2%, the Nasdaq followed, and the Dow lost about 850 points. Tariff threats from President Trump aimed at NATO allies poured fuel on an already nervous fire, with Greenland becoming the unlikely star of the latest trade drama.

(source – Google)

World War 3 fear didn’t help. Between EU retaliation plans and talk of economic “nuclear options,” markets decided it was safer to sell first and ask questions later. Greenland is Greenland, crypto is Redland now.

DISCOVER: 10+ Next Crypto to 100X In 2026

Whiplash, and a Dash for Shelter

Gold prices, on the other hand, jumped to record highs, silver followed, and the shiny rocks still matter. Crypto, though, doesn’t act like digital gold and tracking the S&P 500 almost tick for tick.

BREAKING: Gold extends gains to a record $4,850/oz, now up +$260 in 48 hours.

We are all witnessing history right now. pic.twitter.com/wMkRFkEqrU

— The Kobeissi Letter (@KobeissiLetter) January 21, 2026

Every fund needs bullish news, and Strategy is still bullish. Michael Saylor announced that his company has bought over 22,000 BTC more, dropping more than $2 billion, while we, the retail panic.

Strategy has acquired 22,305 BTC for ~$2.13 billion at ~$95,284 per bitcoin. As of 1/19/2026, we hodl 709,715 $BTC acquired for ~$53.92 billion at ~$75,979 per bitcoin. $MSTR $STRC https://t.co/pJM0Yuy32w

— Michael Saylor (@saylor) January 20, 2026

Following Saylor, Coinbase CEO Brian Armstrong brushed off the crash at Davos, calling it temporary and repeating his long-term vision for a much higher Bitcoin price. Kevin O’Leary also added his usual spice, arguing that regulation and electricity are the future.

So here we are. Bitcoin price is wobbling, the S&P 500 is getting a deep cut, and World War 3 fears are scaring money into motion. It’s messy, and maybe will be for some time.

“Mr President, F*** Off” – Danish MP To Trump During Greenland Debate

DISCOVER:

16+ New and Upcoming Binance Listings in 2026

99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

There are no live updates available yet. Please check back soon!

The post Crypto Market News Today, January 21: No More Bull Run! Bitcoin Price Slides Under $90,000 and S&P 500 Gains Wiped as World War 3 Fear Escalates appeared first on 99Bitcoins.