Solana is undergoing a major shift as big institutional players are increasingly positioning in the network. What was once viewed primarily as a high-performance Layer-1 driven by retail and developer enthusiasm is now attracting serious capital allocations from professional funds, asset managers, and institutional allocators. This trend bolsters the SOL accumulation thesis as an emerging institutional liquidity and infrastructure story.

Why Big Capital Begins Positioning Into Solana

In an X post, Rex reported that the latest wave of institutional interest in Solana confirms what analyst Solana Sensei pointed out, that big firms are actively accumulating SOL right now. Forward Industry alone is holding close to $1 billion worth of SOL, while firms like Defidevcorp and others are sitting on hundreds of millions.

Rex views this move as just the start, and SOL stands out when it comes to real-world asset (RWA) tokenization. Its insane transaction speed, combined with dirt-cheap fees and real scalability, finally makes moving real assets on-chain viable and sustainable. These projects choosing SOL isn’t accidental; they know where the future is heading.

The expert also reflects on the journey. SOL has been addressed as fast but too centralized. Currently, the same institutions that once stayed on the sidelines are quietly stacking billions in SOL, while the real run hasn’t even started yet. SOL is positioning itself to reach levels that may look unimaginable in the next few years. “Supper proud to be part of this,” Rex noted.

While the crowd stayed focused on the 2025 volatility, an analyst known as Senior highlighted that Solana entered 2026 by finally delivering on its biggest technical promise. The Firedancer validator client officially went live on mainnet as of January 2026, pushing the network’s finality to 150 milliseconds and finally ending years of beta resilience and performance concerns.

At the same time, Western Union officially integrated the SOL network. Meanwhile, the Spot SOL ETF surpassed $1 billion in total net assets this week, indicating that the infrastructure has also reached true institutional-grade standards. In the past, the moment SOL transitions from a retail playground to a permanent global financial rail, becoming unshakeable will feel obvious.

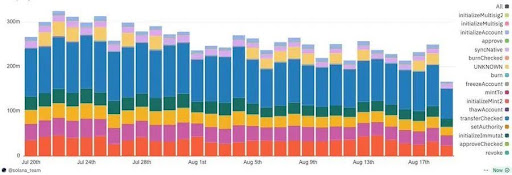

On-Chain Activity Reflects Real Usage Growth

The Solana metrics are growing. Investor and founder of the Inner Circle, Lark Davis, has revealed that the SOL application revenue surged to $2.39 billion, a 46% year-over-year increase and a new all-time high in 2025. SOL network revenue also reached $1.48 billion, representing a 48 times increase over the past two years. Meanwhile, daily active wallets have climbed to 3.2 million, showing that SOL growth is improving.

On January 6th, nearly $900 million in stablecoin supply entered the SOL ecosystem in a single day. Currently, SOL leads all chains in both 24-hour and 30-day DEX volumes, and has emerged as the top blockchain by market capitalization for tokenized stocks.