A sharp drop below $90,000 sent Bitcoin into a fast and heavy shakeout on Thursday, 8 January 2026, wiping out a large block of leveraged long positions across the market.

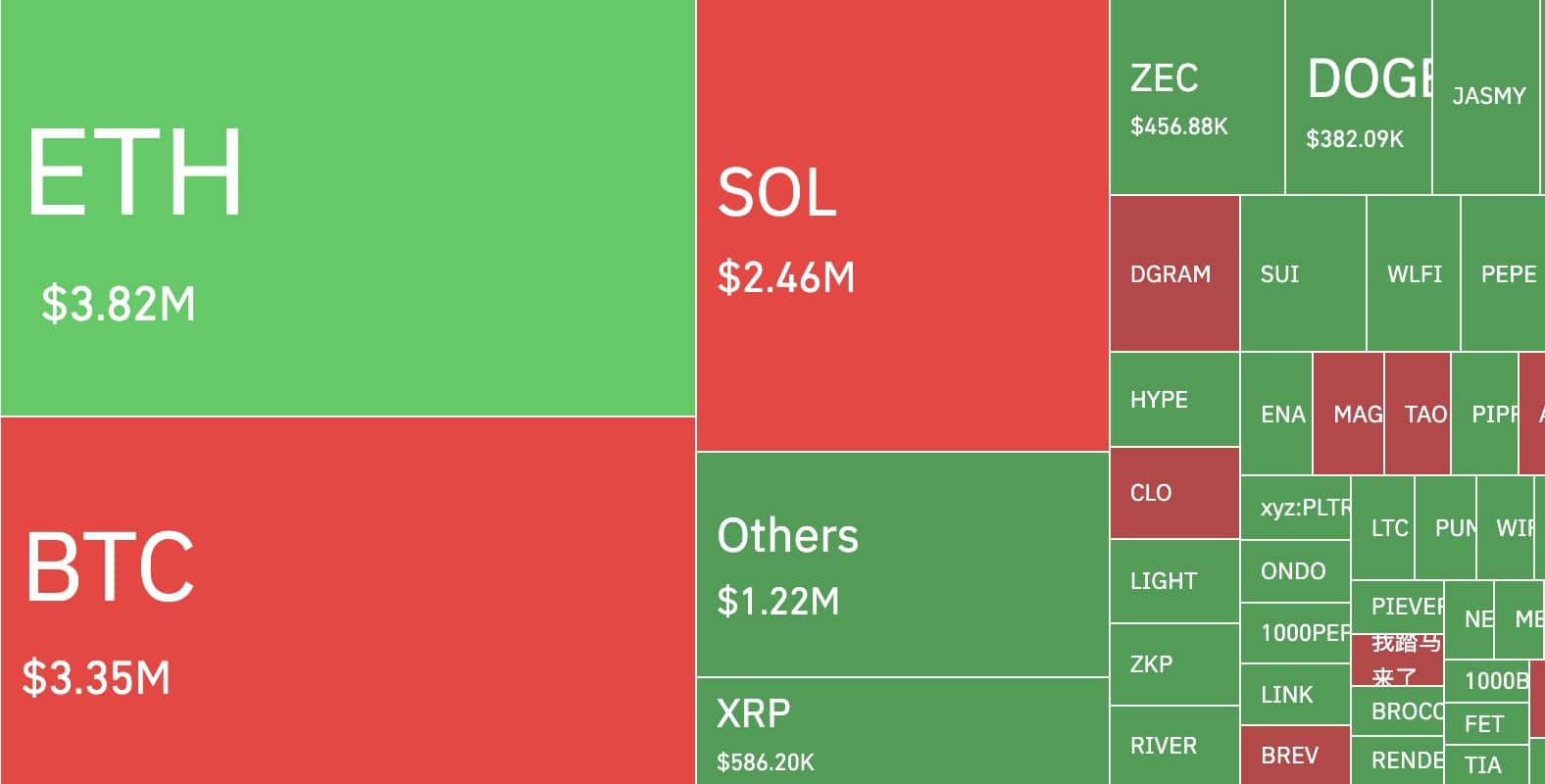

CoinGlass data shows that about $145M in long liquidations were triggered in two quick hourly waves.

The first wave came around 07:00 UTC with $88.23M cleared. The second followed at 08:00 UTC with another $57.02M as Bitcoin briefly slipped under $90,000.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Why Did Hyperliquid See $45M in Liquidations During the Sell-Off?

Hyperliquid took the hardest hit. The rising perpetual exchange logged roughly $45M in liquidations during the sell-off.

It also hosted the single biggest forced order of the period, close to $3.63M.

Hyperliquid accounted for about one-third of the damage during that hour, showing how fast leverage can unwind on one platform when prices fall without warning.

The pressure came as US spot Bitcoin ETF flows turned negative again. Farside Investors reported $486.1M in net outflows on Jan. 7.

The largest withdrawals came from BlackRock’s IBIT at $130M and Fidelity’s FBTC at $247.6M.

The market now waits to see whether the drop was a brief shakeout or the start of a wider cooldown as ETF demand softens.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

HYPE Price Prediction: Is Hyperliquid (HYPE) Forming a Bearish Flag on the 12-Hour Chart?

Hyperliquid’s native token HYPE is losing momentum on higher timeframes, based on a new chart shared by crypto analyst Ali Martinez.

The 12-hour chart shows HYPE forming what looks like a bearish flag after a sharp fall from the $36 zone.

Price has been climbing inside a narrow channel since that drop, creating higher lows and higher highs within two parallel lines.

This kind of structure often signals a pause in the trend, not a full recovery. It suggests buyers are trying to steady the market after heavy selling, but without firm control.

Hyperliquid $HYPE is forming a flag that could result in a move to $19. pic.twitter.com/ujBDmvzrWz

— Ali Charts (@alicharts) January 8, 2026

HYPE touched the upper edge of the flag near $28 and then pulled back, which shows sellers are still active at that level.

The failure to stay above resistance has pushed short-term momentum lower again.

A clean break below the lower trendline would confirm a continuation of the earlier decline.

“If this flag breaks down, Hyperliquid could be heading toward the $19 zone,” Martinez said, noting that this area lines up with previous support.

For now, traders are watching whether the pattern breaks to the downside or if buyers can step in and regain lost ground.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Key Takeaways

Hyperliquid accounted for about one-third of the damage during liquidations.

Hyperliquid’s native token HYPE is losing momentum on higher timeframes, based on a new chart shared by crypto analyst Ali Martinez.

The post Hyperliquid Accounted for Bulk of $150M Long Liquidations During BTC Correction appeared first on 99Bitcoins.