Bitcoin briefly dropped under $90,000 yesterday (January 8) as the early‑January bounce lost steam. BTC slid about 2% on the day but is already back in the green, up +0.4% overnight and reclaiming $90,000. At the time of writing,

is trading for around $90,700.

ETH USD

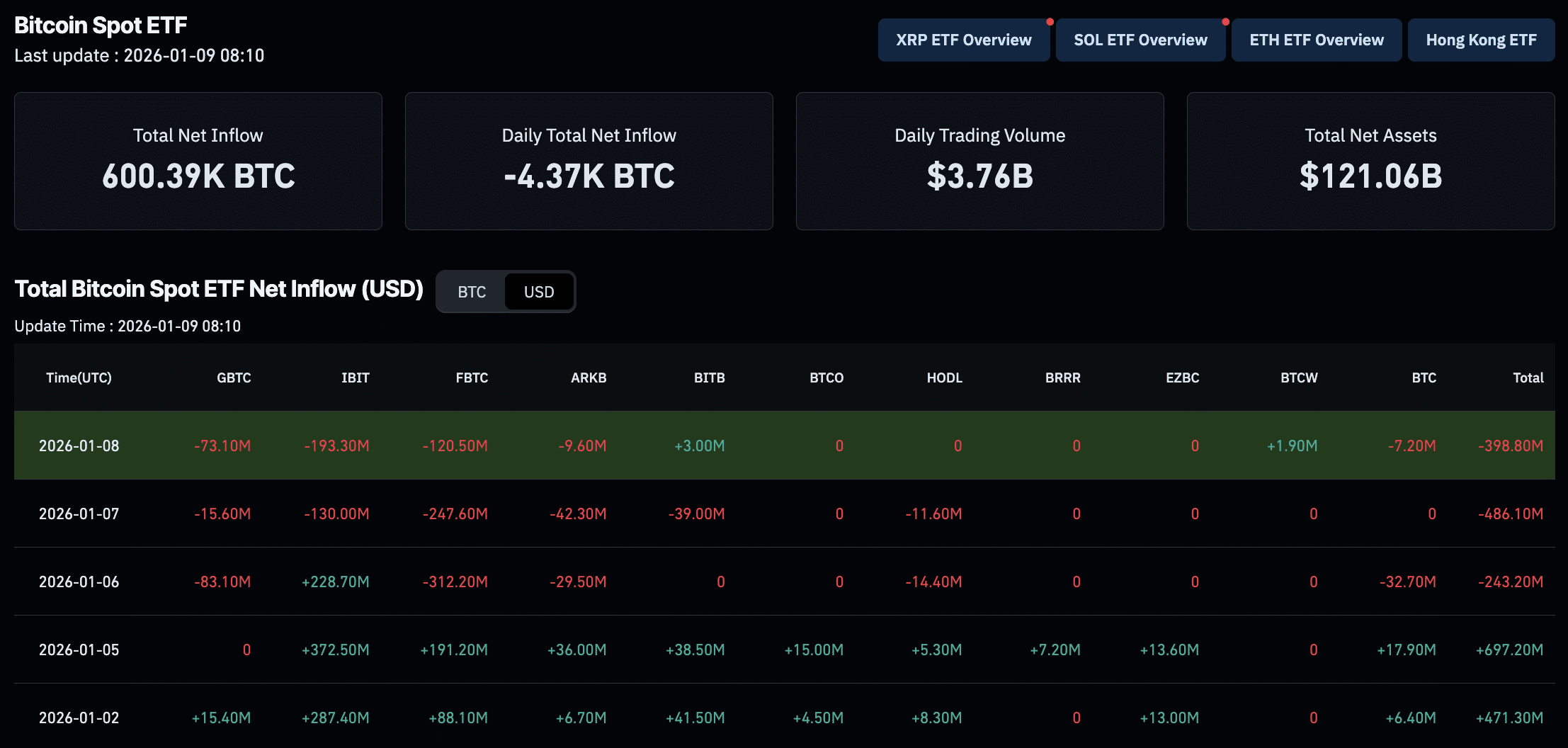

is down nearly -1% over the past 24 hours, with around $ 150Bn wiped off the combined crypto market cap since January 1, a harsh reminder that crypto rallies rarely move in straight lines. The pullback came just as US spot Bitcoin ETFs shed nearly $500M, with macro bets on Federal Reserve rate cuts still driving the narrative.

Why Did the Bitcoin Price Briefly Drop Below $90,000? Is There More Downside to Come?

ETFs are a key driver of the pullback over the past few days, with combined $1Bn in outflows over the past three days, creating heavy selling pressure on the Bitcoin price.

According to CoinGlass data, 2026 started positively for Bitcoin ETFs, with just over $1Bn in inflows recorded in the first two trading days of the year. However, over the past three days, almost the same amount in USD has exited the funds.

Yesterday alone, investors withdrew roughly $486M from US spot Bitcoin ETFs, led by products from Fidelity and BlackRock. A cascading sell-off has seemingly taken hold, with the first round on January 7 triggering a snowball effect as investors scramble to exit their BTC USD exposure.

(SOURCE: CoinGlass)

This matters because ETF demand has powered much of Bitcoin’s climb over the past year. We saw the flip side just weeks ago when strong inflows helped push prices higher, as covered in our explainer on spot Bitcoin ETF flows.

After briefly losing $90,000 yesterday, the Bitcoin price has rallied and is back above $90,500, highlighting strength on the low timeframe. $90,000 is a key technical and psychological support level for BTC/USD, which makes a reclaim of this level a significant move.

Bitcoin ETFs are exchange‑traded funds that allow investors to buy BTC exposure through a regular stock account, with no crypto wallet or knowledge required. When money flows in, it often supports the price. When cash flows out, pressure builds, as we’ve experienced in the past few days.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

How Do Fed Rate Cuts Affect Crypto Prices?

I CAN’T STOP LOOKING AT IT!!!!!!

TOP – FED BALANCE SHEET

BOTTOM – ETH/BTC

Fed balance sheet broke down trend and started to trend up in the last few weeks..

ETH/BTC will break a multi year downtrend and Altcoins will unleash.

I DO NOT CARE that crypto is having a little… pic.twitter.com/GVooyUdNaD

— The House Of Crypto (@Peter_thoc) January 8, 2026

At the macro level, analysts expect the Federal Reserve to cut interest rates later this year after weak US job data showed only 41,000 private‑sector jobs added in December, below forecasts, according to Bloomberg.

Lower interest rates historically have helped risk assets like crypto because cash earns less when held in the bank, which often leads individuals to seek out alternative investment vehicles. That’s why Bitcoin often rallies when bond yields fall. The US 10‑year yield slid toward 4.19%, signaling that traders expect easier money-making opportunities ahead.

So why did Bitcoin still drop? Timing. After a fast New Year pop, some traders locked in gains. ETF outflows amplified that move, just as positive flows in the first few days of 2026 fuelled the upward momentum.

Short‑term selling can override friendly macro signals, but as long as the Bitcoin price holds steady above $90,000, there is still reason to be hopeful for 2026 and beyond.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

What Does This Mean for Everyday Bitcoin Investors?

Crypto Fear and Greed Chart

1y

1m

1w

24h

First, this dip does not break the long‑term story. Bitcoin still trades well above late‑2025 levels and remains tied to macro trends. But it does reset expectations. Fast rallies invite fast pullbacks, triggering a fresh wave of fear and uncertainty among investors.

This pullback has seen sentiment shift quickly, moving from calls of new all-time highs in 2026 to calls of $60,000 as the next target for the Bitcoin price. The Crypto Fear & Greed Index slid into “Fear” after hovering near neutral days earlier. For newer investors, that’s a signal to slow down, not panic.

If you hold BTC, focus on the bigger picture, zoom out, and most importantly, never invest money you need in the short-term for everyday needs. If you’re new and watching from the sidelines, dips after ETF‑driven moves often offer calmer entry points than chasing green candles, as we discussed in our guide to Bitcoin falling below key levels.

Bitcoin remains tied to expectations of Fed policy and ETF flows. There are two key signals to watch that will likely set the rhythm for 2026 and beyond as institutional adoption of crypto accelerates.

DISCOVER: 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin Price Slips Under $92K as ETFs Bleed $500M: What Now? appeared first on 99Bitcoins.