Weekly Crypto Update (Dec 26, 2025 — Jan 2, 2026)

The last week of 2025 didn’t bring fireworks — and that’s exactly why it mattered.

Global crypto market cap slipped slightly (–1 to –2%).

Bitcoin retraced around –1%, yet stayed comfortably above $87,000.

No panic. No hype. Just structure.

And honestly?

That’s how strong markets behave before the next leg.

📊 Market Context: Calm Is a Signal

BTC holding above 85k supportETH stable in the $2.9k–$3k rangeAltcoins selectively strongGold is mildly down, technically neutralVolatility compressed across markets

Low volatility isn’t boring — it’s informative.

⭐ Portfolio Performance Highlights

Most positions stayed flat or slightly negative. One asset didn’t.

Asset Weekly Move What It Tells Me BTC –1% Acceptance above 85k 🔒 ETH +0.5% Structural stability ⚖️ SUI +1–2% Momentum intact (RSI ~66) 📈 AERO ⭐ +40% Ecosystem > speculation 🚀 XRP –<0.5% Neutral, no stress ➡️

AERO’s move wasn’t hype-driven.

It was a reminder that fundamentals still matter in crypto — even in late-cycle markets.

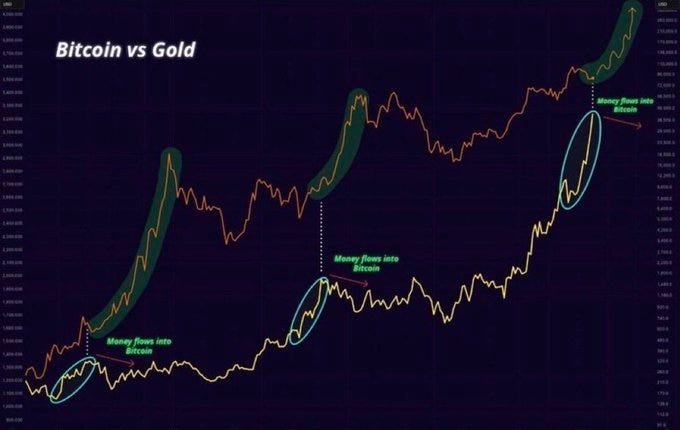

🌍 Bigger Picture: Heading Into 2026

!https://pbs.twimg.com/media/G0a8ffBWkAEj1VN.jpg

Bitcoin briefly touched $88k around New Year’s liquidity, then cooled off.

That’s normal.

What matters:

No structural breakdownNo aggressive distributionLiquidity still patient

My base case:

2026 brings more volatilitySector rotation acceleratesAltseason probability rises in Q2Gold remains a silent macro hedge

Patience is a strategy.

💼 How My Capital Is Positioned

🟢 TradFi / Hybrid

Bitpanda: €1,018 Added silver & gold — €13 gain in one day

🔵 DeFi Stack

VFAT: +$190 Consolidated into ETH poolsKrystal: $1,431 (+$16) XRP/USDT vault, low volatilityPendle: +$6 Locked 13.62% APY, predictable yieldGammaSwap: +$4 Testing phaseAAVE / Moonwell / Navi Conservative LTV, healthy positionsTurbos / Cetus Small positions, fee-testingPAMMs Slow, steady growth

No leverage games.

No forced rotations.

🟩 BEEFY Dashboard: The Backbone

Primary goal: Capital preservation → achieved ✅

Deposits: $8,169Active vaults: 10Lifetime yield: $1,634Estimated daily yield: $3.70

Strategy Check

✔️ No capital loss

✔️ Auto-compounding active

✔️ Risk remains moderate

⚠️ A few low-efficiency vaults (intentional testing)

🎯 Final Thoughts

I didn’t chase yield.I didn’t force trades.I didn’t overreact.

Instead, I shifted from high-APY chaos to structured, sustainable growth.

The institutional wave isn’t here yet —

But positioning early is how you survive it when it comes 🌊

⚠️ Disclaimer

🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑

Disclaimer:

This post is just my personal opinion and ideas. I am not promoting or recommending any cryptocurrency or investment. Please do your own research and be careful when investing. Any decisions you make are at your own risk.

🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑🛑

No Hype, Just Strategy: How I Closed 2025 in Crypto 🧠💼 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.