Ethereum traders, holders, maxis, just cranked their risk to the max as the leverage ratio on major exchanges hit fresh records, making the market hypersensitive to even small price moves.

ETH still trades with heavy derivatives activity while spot buyers watch from the sidelines, forming a market that looks calm on the surface but shakes violently underneath. This comes after months of rate cuts, whale buying, and a refreshed appetite for risk across crypto.

I’m Akiyama Felix, and I’ve been an Ethereum maxi since 2020, but let’s break this down and adjust our risk management accordingly.

Record Ethereum Leverage: What Does It Mean For Ethereum Holders?

Let’s decode the jargon first. Leverage means borrowing money to trade with a bigger position than your actual balance, like using a $100 deposit to control $1,000 worth of ETH. It feels powerful when the price moves your way, but it wipes you out fast when it doesn’t.

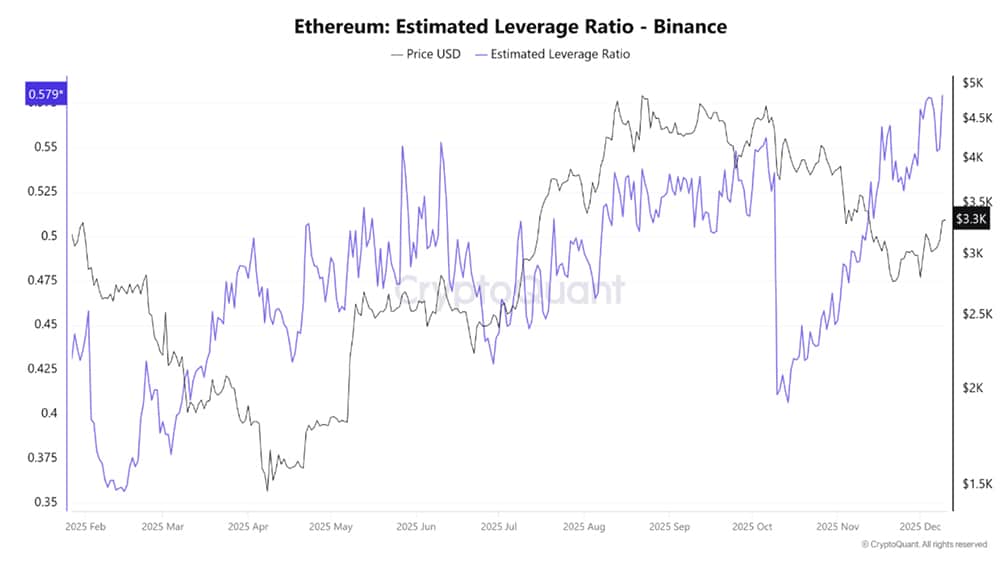

According to HTX Insights, Binance’s ETH Estimated Leverage Ratio recently hovered around 0.57. In simple terms, that ratio shows how much borrowed money traders stack on top of their real ETH. To put it into context, ETH now runs more than double the leverage of Bitcoin, so the second‑largest crypto sits on a thinner safety margin.

This is not just a chart geek problem. When the market gets this stretched, a 3–5% price move can trigger forced selling, known as liquidations. In October 2025 alone, Ethereum traders saw about $3.81 billion in ETH long positions wiped out in just 24 hours during a similar high‑leverage setup. That’s how you turn a small dip into a brutal cascade.

(source – Coinglass)

Big wallets also joined the party. Whales reportedly added more than 218,000 ETH in recent weeks, according to AInvest. Large buyers can support Ethereum price on the way up, but when everyone leans on leverage at the same time, they also face larger liquidation risk if the market snaps lower.

If you want a sense of how ugly this can get, look at past events, such as the significant ETH wipeouts we covered in Ethereum crashes below $ 3,000, where liquidations spike and volatility looms. Or how cross‑market stress hit both BTC and ETH in Bitcoin sees $200M liquidations – what does it mean for Ethereum and institutional demand?

The pattern repeats: too much leverage, small trigger, big mess.

How does this leverage spike affect your ETH Strategy?

Record leverage turns Ethereum into a high‑voltage asset. If you hold spot ETH only (you just bought ETH and don’t borrow or trade futures), you still feel the swings. Prices can whip around faster because leveraged traders get forced in and out of positions. That volatility hits your portfolio value even if you never touch derivatives.

On the derivatives side, products like ETH futures and perpetual contracts on Binance, CME, and other venues now carry higher blow‑up risk. A small move against you can auto‑close your trade and lock in a loss. When you see funding rates spike or everyone brag about 20x–50x leverage, treat it as a warning siren.

BREAKING

A trader who was sitting on a massive $700M leveraged long across ETH and BTC has just been hit with liquidations worth $55M.

What makes it brutal is the context

Nearly two months of roughly $100M in unrealized gains erased, then flipped into a heavy loss.

This is… pic.twitter.com/EdEKQNeycC

— Draxen (@Draxen_Web3) December 16, 2025

History supports that caution. According to AInvest, previous periods of extreme leverage in early 2023 and late 2024 often came right before big ETH breakouts or sharp corrections. That means the current setup can go both ways: explosive rally or nasty flush. Either way, the ride gets rougher.

We also see more ETH locked in structured products, futures, and new perpetual futures offerings. This shifts power from simple spot buyers to leveraged speculators. When derivatives dominate, price reacts less to slow spot demand and more to liquidations and funding flows.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How do you stay safe while Ethereum risk is cranked up?

First rule: if you are new, avoid leverage completely. If you would not take a margin loan to buy stocks, you should not borrow to punt ETH futures. With the current Ethereum leverage ratio on major platforms, the pros have already loaded the spring. You do not need to sit on the grenade with them.

Second rule: if you already trade derivatives, cut position size. Use lower leverage, tighter dollar risk, and hard stop losses. Treat funding spikes, crowded long positioning, and record leverage ratios as reasons to protect capital, not chase one last big move.

Third rule: if you only hold spot ETH and think long term, you do not need to panic. But you should expect sharper up and down days. If big swings keep you up at night, this is a good time to review allocation size instead of refreshing the chart every five minutes.

Remember:

Ethereum thrives on speculation cycles, and high leverage often sits near the center of both wild rallies and scary crashes. Over the next few weeks, expect the market to reward patience and risk control more than bravery and FOMO.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Ethereum Leverage Hits Record Highs: Why Your ETH Now Sits on a Time Bomb appeared first on 99Bitcoins.