The US Securities and Exchange Commission (SEC) has quietly, for those who may not be aware, updated its guidance on how broker-dealers handle cryptocurrencies, making it easier for Wall Street giants like Morgan Stanley and Goldman Sachs to act as custodians.

This change redefines what it means to have “control” over your digital assets. The new framework enables banks to demonstrate custody through legal arrangements, rather than direct possession of private keys, a move that has sparked debate and concerns about investor safety.

Here, I, Akiyama Felix, a member of the Crypto Class of 2018 and key observer of US regulatory developments, will break down the matter.

What Does This SEC Change Actually Mean for Holding Bitcoin?

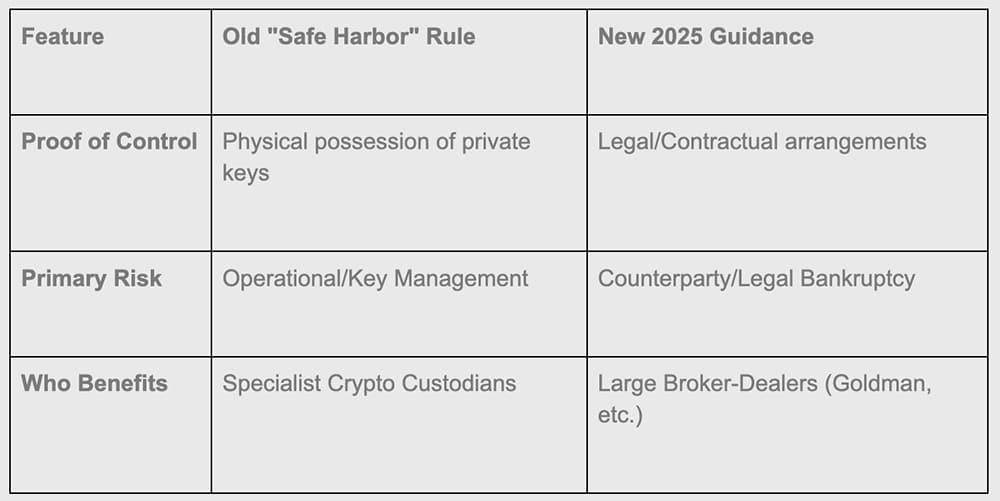

Think of crypto custody like the deed to your house. Previously, regulators had a very strict “safe harbor” rule. This rule required firms to prove they physically held the keys to your crypto, much like holding the actual deed.

The SEC has now withdrawn this stricter guidance. In its place, an updated FAQ suggests broker-dealers can establish “control” through other means, such as complex legal agreements with third-party custodians. Chairman Paul Atkins’ “Project Crypto” and the SAB 122 rescission in January 2025 are the real reasons this is happening.

In simple terms, they can now legally be your crypto’s guardian through paperwork, without necessarily holding the keys in their own vault.

For those of us who lived through the 2022 contagion, the SEC’s shift back toward ‘paper-based control’ feels like a retreat from the very transparency that blockchain was supposed to provide.

This follows a trend of regulators trying to fit digital assets into traditional financial frameworks. Earlier this year, the Office of the Comptroller of the Currency (OCC) confirmed that U.S. banks can offer crypto custody, signaling a wider acceptance of Wall Street’s role in the market.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Why Should You Care About Custody Rules?

This rule change creates a smoother path for large, traditional financial firms to offer crypto services, which could boost Wall Street Krypto-Fonds and institutional adoption. For these firms, managing crypto within existing legal structures is more efficient and less operationally complex than building new systems for direct key management.

But here’s the risk for you:

It blurs the lines of ownership. When a bank holds your assets under these new, flexible rules, your crypto could be treated as part of the bank’s assets in a bankruptcy. This is precisely what happened to customers of failed exchanges like FTX, where user funds weren’t properly segregated. The Uniform Commercial Code (UCC) Article 12 implications for “Controllable Electronic Records” are the legal bridge these banks are using. The SEC has repeatedly warned that many crypto platforms are not “qualified custodians,” as reported by CNBC.

While working with a regulated bank sounds safe, this change removes a critical protection that ensured your assets were treated as yours and yours alone. The risk of Private-Key-Sicherheit und Risiken has not disappeared; it has just been moved into a different legal structure.

Is This Good or Bad for Crypto?

The argument in favor is that this decision lowers the barrier for major financial players to enter the crypto market, potentially bringing trillions in new capital. It treats Bitcoin and Ethereum held by market makers as “readily marketable,” which makes it cheaper and easier for them to support products like Bitcoin ETFs.

However, it also represents a trade-off. It prioritizes convenience for institutions over the fundamental principle of direct asset ownership for individuals. For beginners, it’s more important than ever to understand the difference between buying crypto through a traditional broker and holding it yourself in a private wallet.

This rule change is a clear signal that Wall Street is integrating crypto on its own terms, not on crypto’s original principles of self-sovereignty.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post SEC Quietly Changes Rules, Letting Wall Street Control Your Bitcoin appeared first on 99Bitcoins.