Polygon Crypto is doing something rare in crypto right now: real usage is exploding while the token price barely moves. Well, maybe that’s not exactly new. Looking at you, Solana.

Daily transactions on Polygon have pushed back above 6M, with weekly totals exceeding 40M levels last seen during the 2021 bull cycle. Yet POL USD continues to trade near $0.11, pinned close to cycle lows and showing little interest in celebrating the comeback.

That disconnect is becoming one of the more interesting market stories heading into year-end.

DISCOVER: Top 20 Crypto to Buy in 2025

Polygon Crypto: Polymarket and Stablecoins Are Carrying, So Why Crash?

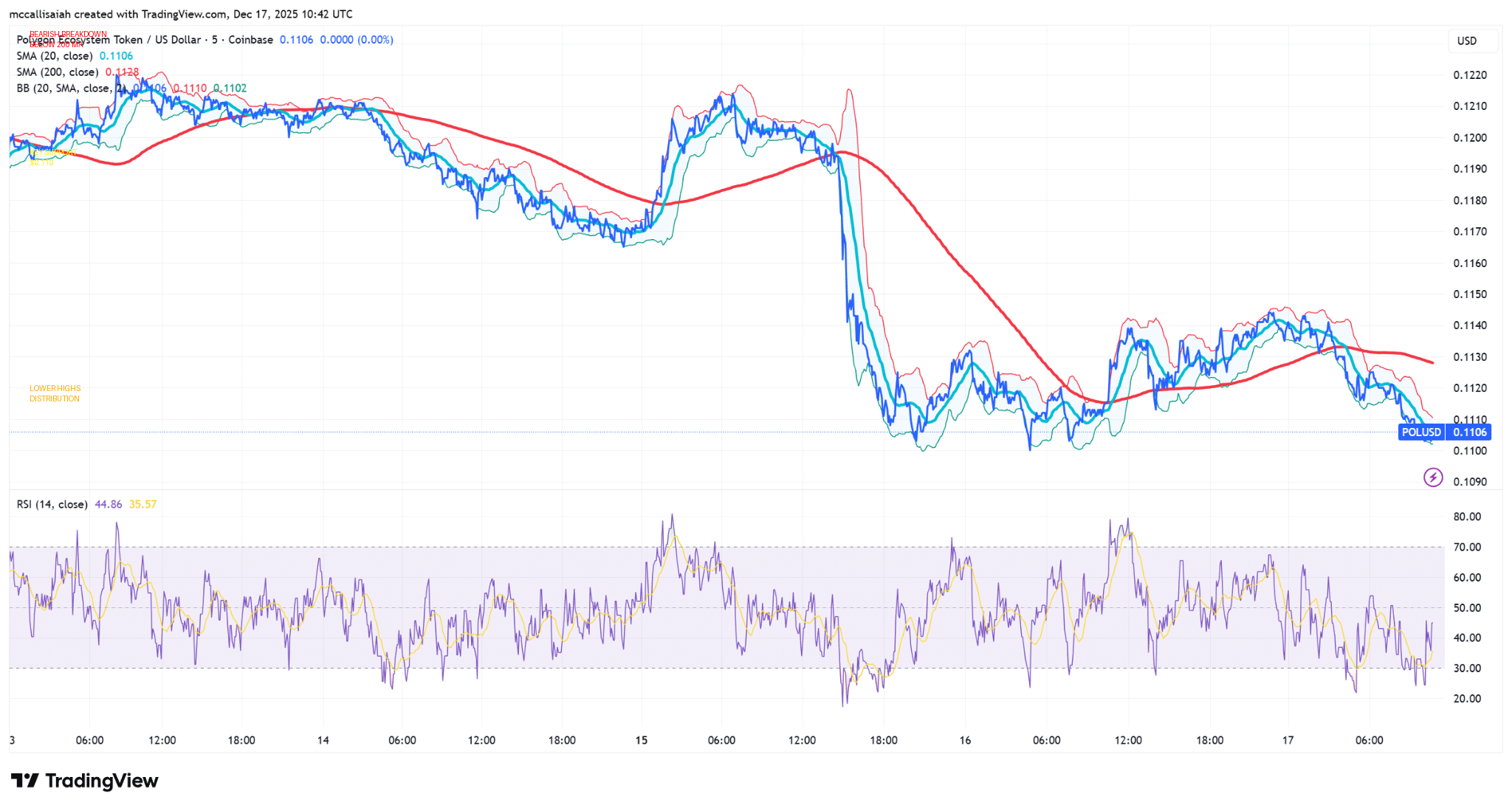

(Source: TradingView)

The transaction rebound for Polygon is not coming from speculative DeFi loops or gaming hype. It is being driven by consistent, utility-heavy demand, led by prediction market activity and stablecoin settlement.

Polymarket’s growth has been a major catalyst. As open interest expanded and large political and macro markets resolved, Polygon absorbed a steady stream of small, frequent transactions, mostly denominated in USDC. On December 10 alone, Polygon processed more than 8.1 Mn transactions, according to network data aggregated by public block explorers.

Unlike 2021, this is not a spike-and-crash pattern. Weekly transaction counts have stayed above 43 Mn, suggesting durable demand rather than short-term farming behavior.

(Source: X)

A recent protocol upgrade lifted Polygon’s throughput capacity by roughly 30%, pushing sustainable performance toward 1,400 transactions per second. That mattered. The network absorbed higher volumes without congestion or fee spikes, reinforcing Polygon’s role as a low-cost settlement layer rather than a flashy application hub.

Data from DeFi Llama shows roughly $2.8 Bn in stablecoin liquidity on Polygon, with USDC accounting for the majority. Peer-to-peer transfers and cross-chain settlement flows continue to grow, even as Polygon’s zkEVM remains comparatively quiet.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why POL Price Still Looks Broken – And Might Not Improve Anytime Soon

(Source: DeFiLlama)

On-chain and derivatives data tell the same story. According to CoinGecko and major futures venues:

POL derivatives open interest sits near $35M, well below prior cycle peaks.

Spot volumes remain muted relative to transaction growth.

Fees paid in USDC weaken the direct link between usage and POL demand.

Technically, the chart remains ugly. POL is stuck in a confirmed bearish structure, with price below the 20-day and 200-day moving averages. RSI struggles to hold above the low-40s, and volume expands on selloffs but fades on bounces. A completed head-and-shoulders breakdown still defines the macro structure.

The silver lining is Polygon clearly has some of the best utility in crypto; don’t be surprised if this thing surges in 2026. You heard it here first.

EXPLORE: Seeking a Career Change? Become a Bitcoin Bounty Hunter in Fordow, Iran

Key Takeaways

Polygon Crypto is doing something rare in crypto right now: real usage is exploding while the token price barely moves.

Technically, the chart remains ugly. POL is stuck in a confirmed bearish structure, with price below the 20-day and 200-day moving averages.

The post Polygon Crypto Transactions Surge to 2021-Era Highs, But Price Is Dying. appeared first on 99Bitcoins.